The latest AICD climate sentiment study reveals a significant turnaround in listed director views on climate change over the past two years – a majority now want to see greater board attention to the issue, up from a third in 2021.

In the most recent Climate Governance Study, there is a notable shift in perspective among listed directors, with 55 per cent expressing a desire for heightened board attention to climate change. This figure marks a significant increase compared to the 33 per cent of listed directors who held this view in the inaugural 2021 study. The proportion of listed directors disagreeing their boards should increase attention to climate change governance also dropped, from 41 per cent in 2021 to 18 per cent, indicating a growing consensus.

The Climate Governance Study 2024 was published in March by the Australian Institute of Company Directors (AICD) in collaboration with Pollination. It draws on the views of 1057 surveyed members, and in-depth discussions with 24 non-executive directors, mostly from ASX 200 companies.

The findings represent a significant turnaround in sentiment in listed sectors in around two years. In fact, the study found listed directors and their boards are leading climate practice in Australia across key measures.

Study finds listed directors more likely to be addressing climate than other sectors

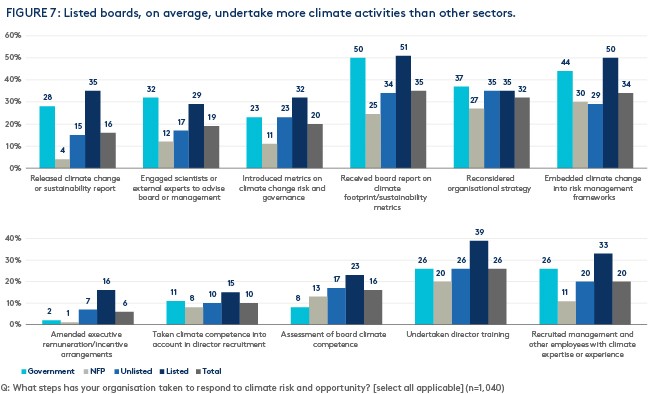

Listed companies were frontrunners in setting climate targets and transition plans, with approximately 43 per cent of listed directors reporting the presence of such plans within their organisations, compared to 23 per cent across other sectors. They had the highest preparedness for mandatory climate reporting (81 per cent), compared with 72 per cent of others.

Engagement on climate capability is also highest in listed sectors: 39 per cent of listed directors were on boards that had invested in director training on climate, compared to a quarter (26 per cent) of directors across all sectors. And around a third of listed companies (35 per cent) had climate in their board skills matrix compared to 23 per cent of others. As previously reported, the study finds 41 per cent of ASX 200 companies had a board committee which considered climate, up from 31 per cent in 2021.

Listed companies are much more likely to have embedded climate change into risk management frameworks (50 per cent) and to have received a board report on climate and sustainability metrics (51 per cent), and metrics on climate risk and governance specifically (32 per cent). They also were more likely to release climate change or sustainability reports (35 per cent) and incorporate remuneration or incentive adjustments (16 per cent) compared to unlisted and NFP respondents.

Yet board confidence is down most in listed cohorts

The study finds, despite increased activity, confidence among listed directors in their boards' capability to address contemporary climate governance issues has waned in recent years. Fifty-one per cent compared to 63 per cent in 2021 believe their board has the requisite knowledge and experience to address contemporary climate governance issues. This is as confidence rises in other sectors.

The study indicates declining confidence may be attributed to factors such as adjusting to new reporting regimes, heightened regulatory scrutiny, and growing awareness of reputational risks associated with unfulfilled climate targets and greenwashing allegations.

In the report, Philip Chronican GAICD said: "The market is currently in a transition from an exploration, ambition, discovery phase, where organisations were making very ambitious scope 1 and 2 emissions targets, to a compliance phase. There is concern by corporates during this transition.”

Boards, particularly those overseeing highly exposed listed entities, are facing mounting pressure to address climate-related risks and opportunities in their decision-making processes. The study finds 53 per cent of listed directors experience pressure from government and regulators in 2024, up from 37 per cent in 2021 – pressure from government and regulators is now equal to that from shareholders and investors.

"Government has a key role to play in reducing regulatory complexity and incentivising access to cheaper clean energy and facilitating the transition,” another ASX non-executive director said in the study.

Policy uncertainty rates as the top barrier for climate governance, consistent with 2021. Forty-four per cent of listed directors (compared to 42 per cent across all sectors) experience uncertainty over Australian government policy as their highest barrier.

Regulatory scrutiny and assurance issues risk tempering ambition

In this context, there is concern that the current market conditions risk tempering climate ambition. Most ASX directors who were interviewed for the study spoke about wanting the highest possible level of assurance (reasonable assurance) for their climate disclosures, but the market not being able to support this due to the nascent nature of sustainability assurance and the lack of capability and/or capacity in the profession.

Directors referred to ongoing scrutiny of listed companies (specifically from legal challenges) as a significant focus for boards. Moreover, legal actions against alleged greenwashing in a highly regulated environment are contributing to a growing sense of wariness among directors which could temper their ambitions and result in more modest targets rather than stretch goals.

Emerging better practice and director recommendations

Informed by engagement with senior, primarily ASX 200, directors, the study also highlights emerging better governance practice and provides recommendations for directors across the areas of strategy, execution, stakeholders and regulation, including:

- Build a strong, commercial and codified case for transition.

- Develop credible, science-based climate transition plans that are embedded at an organisational, and ideally asset, level.

- Ensure alignment between executive pay and incentive structures and the organisation’s climate and broader sustainability goals.

- Explore external assurance/validation options to provide greater confidence in organisation plans and limit liability exposure from reporting.

It recommends policymakers:

- Look to support the business case for transition and acknowledge current technological limitations preventing clear pathways in some highly exposed sectors.

- Address policy complexity, by providing an overall picture of the various strands of climate policy that underpin legislated emissions targets.

- The study also includes messages for investors including:

- Investors need to consider the full cost profile of transition and accept the impact on short-term returns.

- Longer term investors should publicly support genuine corporate efforts to decarbonize, and the level of investment required.

- Investors should act as market exemplars around managing climate risk and opportunity themselves.

Access the four-page snapshot, which highlighting key findings, better board practice and recommendations for directors. For those looking for a deeper dive and recommendations for policy makers and investors, the full report features analysis of how the market has moved since our 2021 study, case-studies and director insights from senior non-executive directors.

Latest news

Already a member?

Login to view this content