Australian economic numbers have been notable mainly for their sparsity this week, perhaps to compensate for a surfeit of headline news since the last update. We’ve seen yet more twists in the increasingly improbable plot line for the US presidential election, one of the biggest-ever global IT outages, surprise rate cuts from the People’s Bank of China, arriving right after last week’s Communist Party Third Plenum and a dose of US financial market turbulence. The data delivered a rebound in the weekly measure of consumer confidence, along with a soft PMI result for July. In the absence of any major releases, domestic attention has instead remained focused on next week’s Q2:2024 Consumer Price Index (CPI) release and implications for the RBA’s 5-6 August Board Meeting.

The consensus forecast for next Wednesday’s inflation numbers was unavailable at the time of writing. But according to the predictions of economists at some of Australia’s largest banks, headline annual CPI inflation in the June quarter is likely to print between 3.7 and 3.9 per cent, while trimmed mean inflation is expected to run at either 3.9 or four per cent. Those forecasts are close to the RBA’s May 2024 projections for 3.8 per cent outcomes for both inflation measures. As noted last week, a result that was above the top of those forecast ranges (at ‘four point something’) would place pressure on the RBA Board to respond with a rate increase. For now, though, financial market pricing continues to predict a much greater chance of no change to monetary policy in early August.

Also, a quick mention that this week sees a special episode of the AICD’s Dismal Science podcast – we have reached Episode #200! As well as a discussion of some of the economic implications of that US election campaign, we also take the opportunity to look back at how the themes and preoccupations of the podcast have changed over time.

What happened on the Australian data front this week?

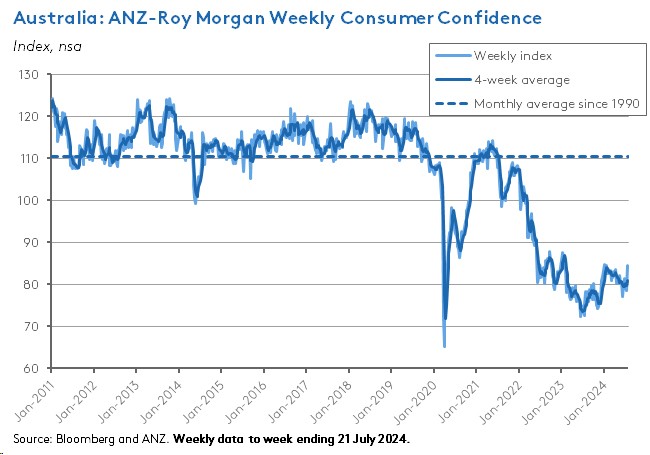

The ANZ-Roy Morgan Consumer Confidence Index jumped five points to an index reading of 84.4 in the week ending 21 July 2024. That was the largest weekly rise recorded since April 2021 and took the index level up to a six-month high. All five subindices increased by more than five index points last week, with the largest gain recorded by the ‘current financial conditions’ subindex, which rose 5.7 points to record its second-strongest result since early last year. ANZ suggested that the sharp increase in confidence was likely the product of Budget 2024’s Stage 3 tax cuts and cost-of-living relief measures starting to feed into an improved financial position for households. Meanwhile, weekly inflation expectations index fell 0.1 percentage point to five per cent.

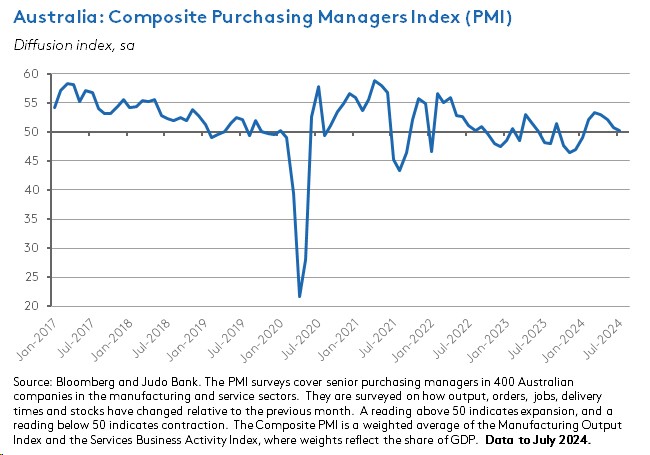

The Judo Bank Flash Australia Composite PMI fell to 50.2 in July from 50.7 in June, hitting a six-month low while still – just – remaining in positive territory. That decline in the overall index mirrored a fall in the Flash Australia Services PMI Business Activity Index from 51.2 in June to 50.8 in July (another six-month low). At the same time, the Flash Australia Manufacturing PMI Output Index dropped to a four-month low of 46.3, down from 46.8 in June. Overall, then, the PMI readings suggest that business activity in the Australian economy is now close to stagnating, with a weaker rise in services activity accompanied by a deeper fall in manufacturing output. Any impact from the Budget’s cost-of-living measures noted above are yet to make themselves felt in terms of output growth, if not in sentiment. The survey results also showed the rate of input cost inflation hitting a 16-month high, which Judo Bank said reflected an acceleration in services input inflation as the Fair Work Commission’s increase in the minimum wage produced greater pay pressures.

Other things to note . . .

- A roundup of pieces from the Conversation on some aspects of last week’s CrowdStrike outage including what happened and why, vulnerabilities in the global information ecosystem, implications for global supply chains, potential for a class action, and the case for business risk management.

- The Productivity Commission (PC)’s Trade and Assistance Review 2022-23. The PC reports that industry assistance fell to $15 billion in 2022-23, down from $15.2 billion in 2021-22, mainly due to the expiry of some remaining COVID-19 stimulus measures. But the PC also notes that industry assistance is likely to trend upwards under the Future Made in Australia (FMIA) program, currently projected to cost $22.7 billion over 10 years. Two of the largest components of the FMIA, production tax credits for renewable hydrogen and for critical minerals projects, are due to become available from 2027-28. Currently, the three largest industry assistance programs comprise the R&D Tax Incentive (16 per cent of total industry assistance), the 15-year asset exemption for small business Capital Gains Tax (nine per cent), and the small business Capital Gains Tax 50 per cent reduction (eight per cent).

- Also from the PC, the Future foundations for giving Inquiry report.

- The AFR Magazine reviews Saul Eslake’s one-man mission to undo the GST deal.

- The Lowy Institute presents a strategic analysis of AUKUS.

- New analysis on how Australian employers recruit.

- Australia has the world’s fifth most ‘powerful’ passport.

- The IMF’s Kristalina Georgieva warns that a low growth world is also an unequal and unstable world.

- The Economist magazine looks at how Kamala Harris carries both the torch and the burden of Bidenomics.

- Also from the Economist, why is Xi Jinping stockpiling commodities?

- The IEA on surging global electricity demand.

- The WSJ’s Greg Ip analyses how US Republican views on the economy are fracturing.

- A BIS Bulletin piece on the housing market, monetary policy, and disinflation.

- Bridgewater sets out the life cycle of (US) stock market champions.

- The global semiconductor talent crunch.

- On Africa’s hobbled hegemons.

- The FT’s Martin Wolf argues that for many rich countries, immigration is simultaneously essential and impossible, and ponders the case for temporary worker contracts.

- Also from the FT, a Big Read on the cost of Europe’s backlash against tourists.

- The Bain Global Wealth Report 2024.

- Gabriel Zucman sets out how to set a minimum effective tax for ultra-high-net-worth individuals.

- A summary of the results from the OpenResearch Unconditional Cash Study.

- A discussion of the ‘three-body problem’ of the intermediate-range nuclear missile race.

- The FT’s Unhedged podcast on the Trump Trade.

- The Odd Lots podcast examines the US-China Race for AI Domination.

Latest news

Already a member?

Login to view this content