After last week’s GDP numbers delivered a reminder of the fragility of economic activity, this week’s labour market release offered a story of ongoing resilience. The labour force data for May showed the seasonally adjusted unemployment rate edging back down to just four per cent as the economy added almost 40,000 jobs last month. Although hours worked fell, the participation rate and the employment to population ratio both remained close to their record highs. All up, a pretty impressive set of results in the face of slowing growth, high interest rates and softer business and consumer confidence.

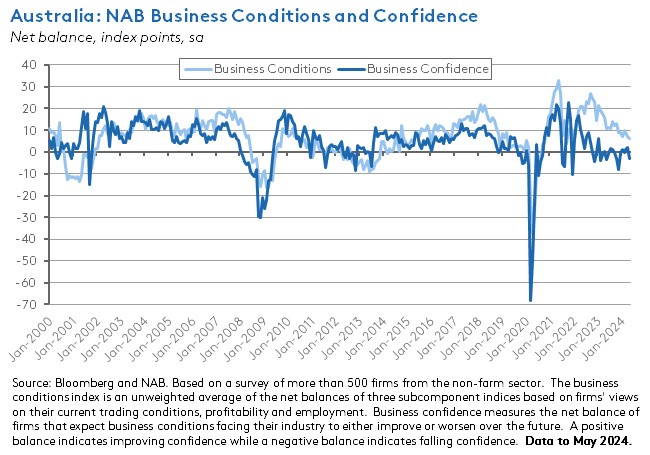

Meanwhile, results of the May NAB monthly business survey signalled a weakening in activity as the business confidence indicator retreated into negative territory and business conditions index slipped slightly. At the same time, the survey results also furnished evidence of persistent cost and price pressures. There’s that narrow path again.

More detail below along with the usual roundup of other data releases and linkage.

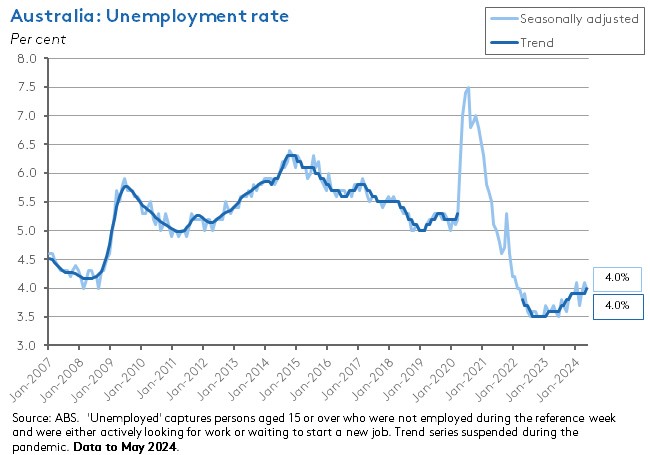

Australia’s unemployment rate falls to four per cent

The ABS said Australia’s unemployment rate fell 0.1 percentage points to four per cent in May 2024 (seasonally adjusted), in line with the market consensus forecast. The Bureau noted that at almost 600,000, the number of unemployed Australians is still nearly 110,000 below the pre-pandemic March 2020 level. On a trend basis, unemployment edged up from 3.9 per cent in April to four per cent last month.

The seasonally adjusted underemployment rate was unchanged at 6.7 per cent, leaving the underutilisation rate likewise constant at 10.7 per cent. Similarly, both the participation rate (at 66.8 per cent) and the employment to population ratio (at 64.1 per cent) remained at the same elevated level reported in April.

The number of employed people rose by 39,700 last month, with full-time employment increasing by 41,700 and part-time employment dropping by 2,100. The market had forecast an increase of around 30,000, so this was a somewhat stronger-than-expected result.

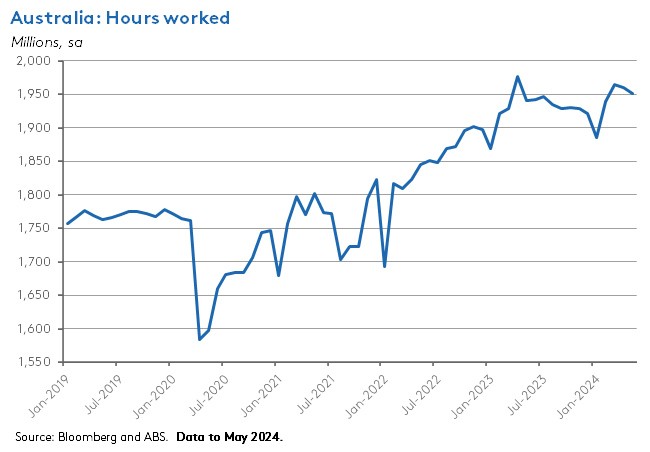

Total hours worked fell by nine million hours (a 0.5 per cent decline) in monthly terms, although they were still 11 million hours (0.6 per cent) higher than hours worked in May 2023.

Economists had expected both a decline in the unemployment rate and a rebound in employment numbers this month after the ABS had noted in the previous April 2024 labour force release that there were more unemployed people than usual waiting to start work. Those expectations were broadly met as the Bureau confirmed that some of the fall in unemployment and rise in employment seen in May reflected these people either starting or returning to work.

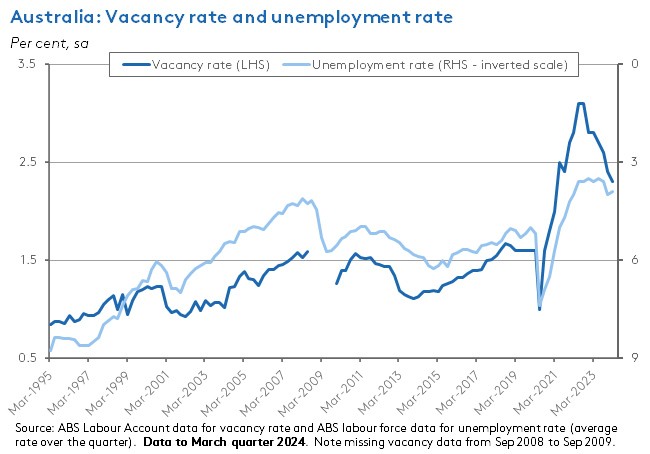

While shifting seasonal patterns continue to influence month-to-month movements in labour market numbers, the underlying story remains one of surprising resilience. Despite slowing economic growth and restrictive monetary policy, the unemployment rate remains comfortably below its pre-pandemic levels. Part of the story here seems to be that labour market adjustment in the current cycle has tended to take a different form than an increase in joblessness. Instead, there have been declines in hours worked along with a fall in vacancy rates, albeit to still high levels (see also the discussion of the March quarter Labour Account data below). Another part of the story could be rapid population growth, which as well as adding to labour supply may also be lifting labour demand. Another possibility is that there has been a shift in firms’ ‘hiring and firing’ behaviour. A key question for the economic outlook is the extent to which these factors will persist through the remainder of this year. Interestingly, official forecasts from the RBA and Treasury both predict relatively modest increases in the unemployment rate from here. The RBA’s May 2024 Statement on Monetary Policy has the December quarter 2024 rate at 4.2 per cent and the June quarter 2025 rate at 4.3 per cent, while the Treasury’s Budget 2024-25 projections pencil in a 4.5 per cent unemployment rate by the June quarter 2025.

Business conditions and confidence both soften

According to the May 2024 NAB Monthly Business Survey, the business conditions index fell one point to a reading of +6 index points, which is just below the series’ long-run average. Of the three sub-indices, employment was up three points to +5 index points, while trading conditions and profitability both fell three points to +10 and +3 index points, respectively.

The survey’s business confidence index fell back into negative territory last month, dropping by four points to -3 index points. Forward orders were up one point but at -6 index points remain deep in negative territory while capacity utilisation edged higher from 83.2 per cent to 83.3 per cent.

Respondents also reported a re-acceleration in cost and price growth measures: labour cost growth rose from 1.5 per cent in April to 2.3 per cent in May (in quarterly equivalent terms) while purchase cost growth was up from 1.3 per cent to 1.9 per cent. At the same time, product price growth rose from 0.8 per cent to 1.1 per cent and retail price growth climbed from one per cent to 1.6 per cent.

Overall, then, the business survey results – weaker readings on activity, ongoing price pressures – echo the message from previous data releases regarding the persistence of two-sided economic risks in the economy. We’re still on that narrow path and the footing remains precarious.

What else happened on the Australian data front this week?

The ABS said Australia’s population was 26,966,789 people at 31 December 2023.That was up 2.5 per cent over the year. Of the total annual increase of 651,200 people, natural increase accounted for 103,900 (a 16 per cent share) while net overseas migration contributed 547,300 (84 per cent).

The ANZ Roy Morgan Consumer Confidence Index slumped by 3.5 points to a 2024 low of 77 in the week ending 9 June. All five subindices fell over the week with particularly large drops for ‘short term economic confidence’ (down 5.6 points), ‘future financial conditions’ (down 4.9 points) and ‘current financial conditions’ (down 4.2 points). The subindices capturing the economic and financial outlook are now at their lowest level since November last year. Weekly inflation expectations fell 0.2 percentage points to 4.8 per cent.

According to the ABS, short-term visitor arrivals to Australia were 593,090 in April 2024, representing an annual increase of 8.8 per cent. Total arrivals were 1,634,580, up 19.3 per cent on April 2023.

There were 48 industrial disputes in Australia in the March quarter 2024, involving 12,800 employees and 16,800 lost working days. Over the year ended March 2024, there were 207 disputes and a total of 108,300 working days lost.

The ABS said its April 2024 Monthly Business Turnover Indicator rose 1.5 per cent (seasonally adjusted) over the month, with eight of the 13 industry divisions included in the indicator reporting increases. The largest rises in monthly turnover were in Professional, scientific and technical services (up 5.5 per cent) and Wholesale trade (up 3.1 per cent) while the largest falls were in Arts and recreation services (down 3.4 per cent) and Information media and telecommunications (down 1.4 per cent). According to the Bureau, that 1.5 per cent aggregate monthly increase was the largest since September last year. On an annual basis, turnover was up 2.9 per cent for the 13-industry aggregate, led by gains for Electricity, gas, water and waste services (up 14.8 per cent) and for Construction and Information media and telecommunications (both up 9.2 per cent). The only industry to see turnover fall over the year was mining (down 8.8 per cent).

The total value of residential dwellings in Australia rose by $209.4 billion to $10,720.7 billion in the March quarter 2024. The ABS said the number of dwellings rose by 52,700 to 11.2 million, while the mean price of a residential dwelling rose by $14,300 to $959,300. That mean price ranges from a high of $1,212,000 in NSW to a low of $511,400 in the Northern Territory.

Last Friday, the ABS published the Labour Account for the March quarter 2024. The data showed the number of total jobs increased by 0.6 per cent over the quarter (seasonally adjusted) and by 2.2 per cent over the year to 16 million, while the number of filled jobs rose 0.8 per cent quarter-on-quarter and 2.4 per cent year-on-year to 15.7 million. Hours worked increased 0.1 per cent in quarterly terms and 1.1 per cent in annual terms to 5.8 billion hours. In a sign of ongoing labour market easing, the proportion of vacant jobs fell to 2.3 per cent. That was the lowest vacancy rate reported since the March quarter 2021, down significantly from the peak of 3.1 per cent recorded in the June and September quarters of 2022, although it was still well above the pre-pandemic rate of 1.6 per cent. The ABS also published a short introduction and guide to the Labour Account data.

In the March quarter of this year, there were 974,000 multiple job holders, or 6.7 per cent of employed people. According to the ABS, pre-pandemic the rate of multiple job holding was relatively stable at between five and six per cent. But following a large decline at the start of the COVID-19 period, the rate has risen steadily before stabilising at around 6.6 to 6.7 per cent since the December quarter 2022.

Also last Friday, the ABS published the April 2024 version of its Monthly Household Spending Indicator. The numbers show household spending rising 3.4 per cent over the year (current price, calendar adjusted basis). Spending on services was up 6.9 per cent in annual terms, while spending on goods fell 0.7 per cent. Household spending on non-discretionary items including food and fuel rose 5.8 per cent year-on-year, while discretionary spend was up by a much more subdued 0.6 per cent, with declines in spending on goods for recreation and culture, and clothing and footwear. The Bureau also highlighted a 15.7 per cent annual increase in spending on health and a 12.9 per cent rise on spending on miscellaneous services including childcare, professional services, and personal care.

Other things to note . . .

- Jeff Borland says despite this week’s positive labour market numbers, there are still growing signs of weakness.

- The Treasurer’s address at the Morgan Stanley Australia Summit: A soft landing on a narrow runway.

- In the AFR, Warwick McKibbin warns that the Australian economy is at a critical juncture with inflation above target and minimal economic growth. In his view, the key problem is a ‘productivity crisis’ with ‘capacity constraints throughout the Australian economy’.

- Grattan’s Tony Wood says Australia may miss its 2030 emissions reduction target, with the renewable electricity target most at risk due to a mix of cost overruns, regulatory delays and a failure to adequately address social licence issues. He also has three suggestions to improve things.

- The June 2024 Quarterly Statement by the Council of Financial Regulators judges that risks to the Australian financial system from lending to households and businesses ‘remain contained’. Despite a rise in the share of borrowers falling behind on mortgage payments, this has been from a low level. Regulators are also monitoring challenging conditions in global and domestic commercial real estate markets.

- The ASPI Defence budget brief 2024-25 highlights the large gap between political rhetoric (which tells us we’re in the gravest geopolitical period in generations) and defence investment, despite a government acknowledgment that ‘the warning time before any conflict, which had long been set at 10 years, has shrunk to effectively zero time’.

- New Productivity Commission research looking at why Australian investment hurdle rates are so high. Hurdle rates are the required rate of return before a firm is willing to invest and an important puzzle for the pre-COVID Australian economy was the gap between high hurdle rates on the one hand and low interest rates and cost of capital on the other. The paper argues that the gap can be explained by a rising market risk premium, although it’s not clear whether this is due to an increase in the actual risk faced by investors or an increase in risk aversion.

- Chris Murphy reviews personal income tax cuts and fiscal policy and argues that Treasury’s modelling on the efficiency impact of the revised Stage 3 tax cuts underplays efficiency-equity trade-offs involved.

- Four years on from the COVID-19 outbreak, a look at who is better off and who is worse off. The authors of the referenced study reckon that overall Australian living standards were 0.6 per cent lower in December 2023 compared to December 2019 (although by December this year they are expected to be 1.3 per cent higher). They also find that the two groups who saw significant growth in living standards were the lowest and the highest quintiles in income distribution, with the middle three quintiles seeing either very little growth (the second lowest quintile) or outright declines (the middle and upper-middle quintiles). Low-income households did relatively well in part because their payments were inflation-indexed, while high-income households did well, partly because their investments performed strongly. Those in the middle suffered in large part because they suffered from higher interest payments on their mortgages.

- Helpful explainer from the Parliamentary Budget Office on dividend imputation and franking credits.

- The latest volume in ANU’s China Story Yearbook considers China’s New Era.

- A WSJ long read looks at why the long-anticipated US recession has failed to show up.

- Dario Perkins explains why ‘everyone hates this economy (except economists)’. (Part of his explanation ties into the Odd Lots podcast and related article linked to last week.)

- Torsten Slok notes that the consensus view is that the global economic outlook is improving with significant declines in recession probabilities for Europe, the UK and the United States.

- This edition of the BIS Bulletin analyses Emerging market resilience.

- On Information and Communications Technology (ICT) and productivity growth.

- The IISS Asia-Pacific Regional Security Assessment 2024.

- Brookings’ Robin Brooks on Japan’s falling yen and fiscal space.

- The IEA’s Oil 2024 report argues that a combination of slowing growth in global demand, plus a ramp-up in worldwide oil production means the medium-term outlook for the oil market is for a return to the kind of spare capacity levels only previously seen during the peak of the COVID-19 lockdowns in 2020.

- An FT Big Read on South African politics.

- New OCED data show that developed economies mobilised US$115.9 billion in climate finance for developing countries in 2022. That means they exceeded their $100 billion goal for the first time, reaching a level not expected before 2025 (albeit two years later than the initial pre-COVID target date of 2020).

- The Economist magazine explains why global GDP might be US$7 trillion bigger than everyone thought.

- Peterson Institute research on the links between El Nino and geopolitical risk.

- IMF research considers how weather shocks intensify conflict.

- The Conversations with Tyler podcast with Bulgarian geopolitical strategist Velina Tchakarova

Latest news

Already a member?

Login to view this content