Following the 6-7 May RBA Board meeting, I wrote that the uncomfortable juxtaposition of a disappointingly high March quarter 2024 CPI reading with evidence of the ongoing weakness in household consumption kept the RBA in the awkward position of having to manage two-sided economic risks.

On one side was the danger that inflation was going to take even longer to return to target than anticipated. On the other, the fear that demand in the economy would turn out to be much weaker than expected. Two of this week’s key data releases provided a reminder that these contrasting forces are still very much in play.

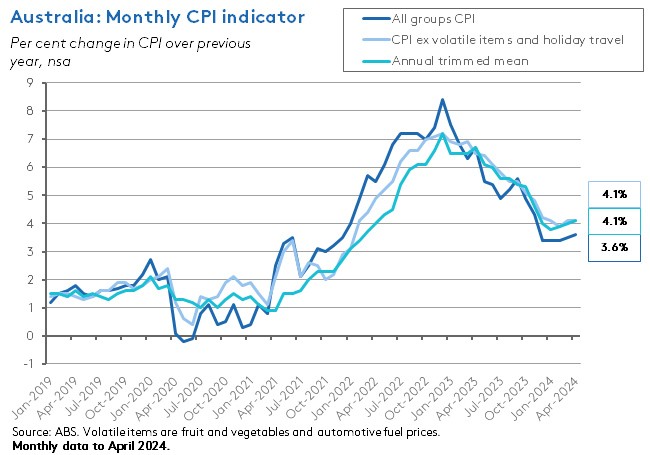

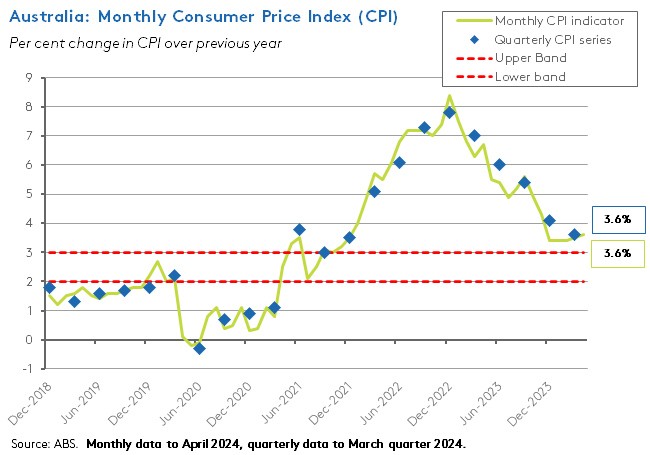

First, the monthly Consumer Price Index (CPI) Indicator for April 2024 rose at an annual rate of 3.6 per cent. Not only was that stronger than economists had expected (the consensus forecast was for a 3.4 per cent increase), but it was also the highest monthly reading since last November. With the two accompanying measures of underlying inflation also showing price growth either unchanged from the March outcome or edging higher, the latest batch of monthly numbers suggest that at best the disinflation process has now slowed quite significantly over the first fourth months of this year. A more pessimistic take would be that disinflation has stalled.

Second, however, the retail sales numbers for the same month came in weaker than expected, and on a trend basis show that total retail turnover has largely stagnated since the start of this year. Further, when considered in per capita and/or in volume terms, turnover has gone backwards. That indicates that household spending remains very weak, in line with ongoing depressed consumer sentiment readings.

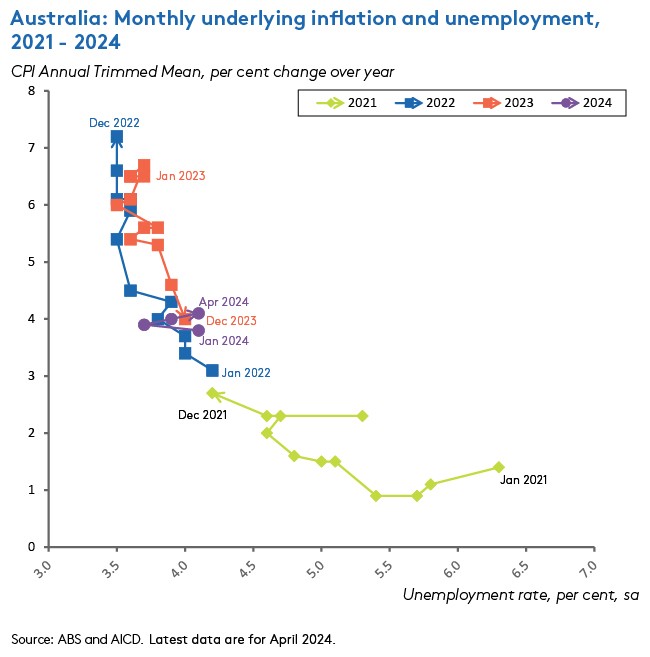

So, what does this familiar combination mean for the RBA Board when it next meets on 17-18 June? While Australia’s central bank is now almost certain to again consider the case for a rate hike, the likelihood is that it will decide to remain on hold for a fifth consecutive meeting. The RBA has already said that it expects that the ‘path of inflation on its return to target is unlikely to be smooth’ and the Board has also said that it is ‘reasonable to look through short-term variation in inflation to avoid excessive fine-tuning.’ That declared stance, plus the persistence of downside risks to activity, suggests the most likely option is for the Board to stick with the current already-restrictive target for the cash rate. Despite this week’s reminder of the uncertainty around future household spending, however, in our data dependent monetary policy environment the new inflation numbers do raise the bar for any consideration of a future reduction in interest rates. As such, they further push back the likely timing of a first cut to the cash rate target – possibly into the first quarter of next year instead of my previous estimate of ‘November’s meeting at the earliest’. Note that financial markets are considerably more conservative than this. They currently do not foresee a rate cut until the end of 2025.

The monthly CPI indicator surprised to the upside in April

According to the ABS, the Monthly Consumer Price Index (CPI) Indicator rose 3.6 per cent over the year to April 2024. That compares to a 3.4 per cent print in February and a 3.5 per cent rise in March and marks the highest annual increase since last November (4.3 per cent). It was also above the consensus market forecast which had expected the headline rate to ease to 3.4 per cent.

Monthly measures of underlying inflation show that the annual rate of increase in the CPI indicator excluding volatile items and holiday travel was unchanged at 4.1 per cent in April, while the Annual trimmed mean inflation rate rose from four per cent in March to 4.1 per cent in April.

To set against all that unwelcome news, the ABS did report that the rate of month-on-month increase (seasonally adjusted) in the CPI indicator eased in April, down from 0.4 per cent in January and February and 0.5 per cent in March to 0.2 per cent last month.

The Bureau said that the most significant contributors to April’s headline result were:

- Housing, which was up 4.9 per cent over the year, down from 5.2 per cent in March. Within this group, rents were up 7.5 per cent (down from 7.7 per cent in March) while new dwelling prices rose 4.9 per cent. The ABS also noted that rental inflation in April was held down by increases in Commonwealth Rent Assistance (CRA) and that rents excluding CRA were up 0.7 per cent over the month, while including CRA they rose by 0.5 per cent. Electricity prices, also part of the housing group, rose 4.2 per cent over the year (down from 5.2 per cent in March). Again, government policy had an offsetting impact here, via the introduction of the second instalment of the Energy Bill Relief Fund rebates for eligible households in Hobart, which the ABS said led to a 1.9 per cent fall in the level of Australian electricity prices over the month.

- Food and non-alcoholic beverages rose 3.8 per cent (up from 3.5 per cent in March). This was mainly due to the largest annual rise in fruit and vegetable prices since April 2023 driven by unfavourable weather conditions, although all food categories except meat and seafood contributed to the rise.

- Alcohol and tobacco prices, which were up 6.5 per cent over the year.

- And transport prices, which rose 4.2 per cent over the year, mainly due to higher automotive fuel prices (up 7.4 per cent over the year), which rose for a third consecutive month in April.

Three other developments are also worth noting. Health group CPI inflation was up 6.1 per cent over the year compared to a 4.1 per cent rise in March. That reflected an increase in health insurance premiums which rose on 1 April. Holiday travel and accommodation prices fell 6.2 per cent over the year to April, although in month terms prices rose for the first time since December last year. And inflation in Insurance and financial services remains high, unchanged at an annual rate of 8.2 per cent last month.

What do these latest monthly numbers tell us about Australia’s progress with disinflation? First, a quick reminder regarding the volatility in the monthly numbers, the staggered process of price updating that occurs over the quarter that limits the coverage of the first month of the quarter’s results (the April CPI includes up to date price information for about 66 per cent of the weight of the quarterly CPI), and the RBA’s much greater focus on the quarterly measure of the CPI. Keeping all that in mind, the broad message from the April release is that it provides more evidence that the pace of disinflation has slowed markedly since the start of this year.

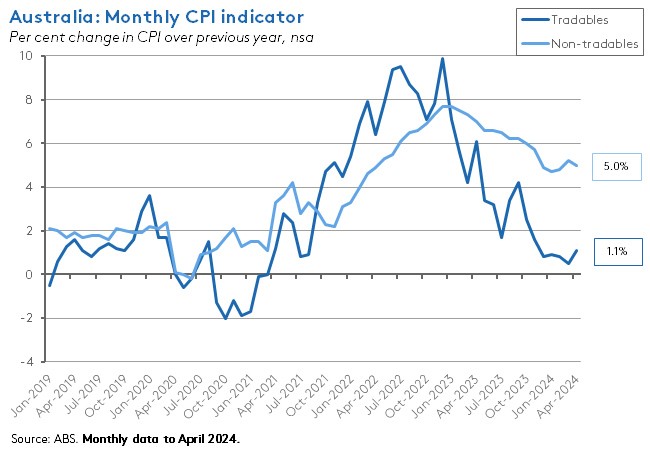

That story is consistent with the ongoing divergence between persistent domestic price pressures in the non-tradables / services sector (particularly rents and insurance) and a more muted inflation story from the tradables / goods sector. Thus, despite an uptick in April, the annual rate of tradable inflation was just 1.1 per cent last month while non-tradables inflation ran much hotter at five per cent. Similarly, services inflation (at four per cent) continued to outpace goods inflation (at 3.3 per cent) – although here note again that not all services prices were updated in the first month of the quarter.

This narrative is also consistent with the theory that the ‘easy’ disinflation that was associated with the quite rapid reversal through 2023 of 2022’s inflationary surge is now mostly done, with the monthly CPI having gone sideways or up over the first four months of this year.

When the RBA updated its inflation forecasts in the May 2024 Statement on Monetary Policy, it said that it now expected inflation to be higher by around half a percentage point through until the end of this year, with the annual headline rate of quarterly CPI inflation expected to run at 3.8 per cent in both the June and December quarters of 2024. In that context, the latest monthly CPI outcome probably won’t come as a surprise. But it will still be a disappointment for Martin Place, compelling the RBA to maintain its declared two-way bet on the likely next move in the cash rate target.

Retail sales were little changed in April as household spending remains subdued

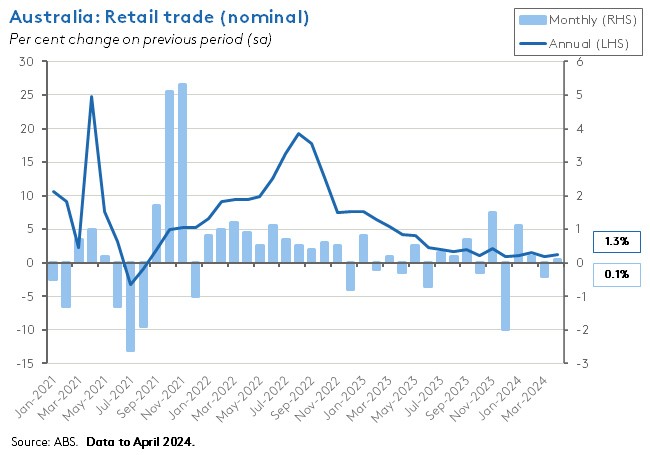

The ABS said that in April 2024 total retail turnover was up just 0.1 per cent over the month and 1.3 per cent over the year (seasonally adjusted). That was a stronger result than the 0.4 per cent month-on-month contraction and 0.9 per cent annual growth outcomes reported for March 2024. But it was weaker than the consensus forecast, which had expected 0.2 per cent growth over the month.

On a trend basis, turnover was flat over the month and has been little changed since the start of this year, with the Bureau noting that Australian consumers have continued to wind back their spending on discretionary items in the face of ongoing cost-of-living pressures.

Recall that these are all nominal numbers and include the impact of inflation. It follows that in volume terms retail spending is even weaker. Also note that with Australia’s population growing at around 0.3 per cent over the month and 2.9 per cent over the year (based on the ABS estimate for growth in the civilian population aged 15 years and over) turnover once again went backwards in per capita terms on both a monthly and an annual basis.

Overall then, this was another weak reading on Australian spending and as such was in line with the persistent weakness in consumer confidence highlighted last week. One of the key uncertainties for the economic outlook over the second half of this year is whether budget stimulus (primarily in the form of the reworked Stage 3 tax cuts) will encourage households to resume spending again, or if a further weakening in labour market conditions will instead prompt a rise in precautionary savings. According to the minutes of the May RBA meeting, recent data have shown households maintaining a higher rate of saving than the RBA had expected.

What else happened on the Australian data front this week?

The ABS said that the real value of total construction work done in the March quarter 2024 fell 2.9 per cent quarter-on-quarter (seasonally adjusted) to $64 billion. That was 1.8 per cent higher than the corresponding total in the March quarter last year. The value of building work done was down 3.7 per cent over the quarter with falls for both residential (down 1.2 per cent) and non-residential (down seven per cent) construction. Both also declined in annual terms. Engineering work done fell 2.1 per cent over the quarter but was 6.2 per cent higher over the year.

Total dwellings approved in April 2024 fell 0.3 per cent over the month (seasonally adjusted) to 13,708. That was up 3.5 per cent on the corresponding number of approvals in April 2023. According to the ABS, approvals for private sector houses were down 1.6 per cent over the month to 8,822 but were still nine per cent higher than in April 2023. Approvals for private sector dwellings excluding houses fell 1.1 per cent over the month and were lower by 8.5 per cent over the year, at 3,981. On a trend basis, the total number of dwelling units approved in April was just 12,628. That compares to a monthly average of a little over 16,000 going back to April 2009.

Total new private capital expenditure (capex) rose by one per cent over the March quarter 2024 (seasonally adjusted) to be 5.5 per cent higher over the year. Expenditure on buildings and structures fell 0.9 per cent quarter-on-quarter but rose 4.7 per cent over the year. Expenditure on equipment, plant and machinery rose 3.3 per cent in quarterly terms and grew by 6.5 per cent on an annual basis. The ABS said that business investment was up 3.3 per cent in the non-mining industries over the quarter while mining capital expenditure fell 4.7 per cent over the same period due to a reduction in spending on iron ore and LNG projects. Investment growth was strongest in Transport, postal and warehousing (up 15.8 per cent) driven by higher spending on vehicles along with ongoing capex related to large infrastructure projects. The Bureau also highlighted investment in data centres which it said contributed to a 60.6 per cent jump in equipment and machinery capex in the information, media, and telecommunications industry. This release also included new estimates for capex in the current financial year and expected capex in 2024-25. Both depicted a strong investment performance. Thus, Estimate 6 for expenditure in 2023-24 was $180.6 billion, which was 2.5 per cent higher than Estimate 5 and 11 per cent higher than corresponding Estimate for the previous year. Turning to 2024-25, Estimate 2 was $155.4 billion, up 6.8 per cent from Estimate 1 and almost 13 per cent higher than the corresponding figure this year. Once again, the ABS highlighted the information, media and telecommunications industry which showed ‘an extraordinarily large rise in expected capex from further planned investment in new data centres.’ In addition, the electricity, gas, water and waste services industry reported an expected big rise from investment in renewable energy infrastructure.

The ANZ Roy Morgan Consumer Confidence Index fell 1.8 points to an index reading of 80.2 for the week ending 26 May 2024. That unwound last week’s modest post-Budget bounce and took the level of confidence down to a 2024 low. Confidence has now been below 85 for a record-breaking 69 straight weeks and is running more than 30 index points below its long-term average (although it is modestly higher than last year’s average of 78 index points). In terms of the subindices, the outlook for the next year looks to have deteriorated: household confidence in the short term (12-month) outlook for the economy suffered its largest weekly drop since February 2023, and is now at its lowest level this year, and there was also a sharp 4.1-point drop in the ‘future financial conditions (next 12 months)’ measure. On the other hand, there was a marginal increase for the ‘current financial conditions’ subindex and a modest rise for the ‘medium term economic confidence (next five years)’ subindex. Weekly inflation expectations edged higher by 0.1 percentage points to 4.9 per cent.

Other things to note . . .

- A post-Budget briefing from Secretary to the Treasury, Steven Kennedy.

- The AFR’s Michael Read on what immigration cuts really mean for the Australian economy.

- Kristen Sobeck on Ed Husic and the reform of company tax and the case for an Allowance for Corporate Equity.

- ABC Business’s Gareth Hutchens considers whether ‘The Property Investors Club’ and ‘The Fossil Fuel Club’ are the modern equivalents of ‘The Industrial Relations Club’.

- How 49 economists graded Budget 2024-25 on ‘delivering on inflation in the near term and then growth in the medium term’. The most common grade (awarded by 36 per cent) was a ‘C’.

- John Freebairn critiques the government’s Future Made in Australia policy.

- The Memorandum of Understanding between the EU and Australia on a Partnership on Sustainable Critical and Strategic Minerals. Official press release. A sign of hope for the currently stalled Australia-EU Free Trade Agreement (negotiations were originally launched back in June 2018)?

- Jacqui Dwyer, head of the RBA’s Information Department, gave a speech on The State of Economics with a focus on ‘the landscape of economics education and economic literacy’.

- The Economist magazine covers the pro-natalist turn in rich countries’ economic policies and the economics of shrinking populations. Related from the same source: why the spending and savings patterns of Baby-boomers matters for global economic growth. See also Martin Wolf in the FT on the shift from baby boom to baby bust (here is the AFR version) and this FT Big Read asking if Europe has already reached its demographic tipping point. Readers may recall that I linked to a WSJ piece on this topic last time, so it seems reasonable to argue that demographic trends have become a key theme recently. Long-term listeners to our Dismal Science podcast (or attendees at some of my presentations over the past couple of years) may also recall that I’ve been arguing for a while now that (1) the COVID-disrupted labour market when our borders were closed to overseas labour could be seen as an early test of what a demographically-constrained labour market might look like and (2) that a key macro theme for the future is the ‘race’ between AI and automation on the one hand and the global demographic transition on the other.

- Goldman Sachs on global monetary easing.

- Torsten Slok analyses the outlook for inflation and interest rates.

- The Peterson Institute charts the surge in investment in US factories since end-2022.

- A look at the Russian economy on a war footing. According to the authors, high oil revenues and increased public spending on war-related industries and construction have underpinned economic growth.

- And how Brexit (and a weaker GBP) has seen UK exporters shift from sterling to US dollar invoicing.

- David Leonhardt reckons that a new centrism is rising in Washington DC that has replaced the old Washington Consensus (neoliberal) centrism with a kind of ‘neopopulism’ that combines scepticism about free trade with a positive view of industrial policy.

- Compare and contrast with Ruchir Sharma’s long essay in the Weekend FT asking, What went wrong with (US) capitalism? A big part of his answer is ‘socialised risk’ which Sharma defines as ‘a campaign to inoculate an entire society against economic downturns’ comprising ‘addicting the system to a drip feed of government support’ along with a ‘suite of habits – borrow, bail out, regulate, stimulate’. Sharman reckons that overactive governments and easy money have produced slower growth that is more unfairly distributed and has seen ‘three out of every four US industries…ossified into oligopolies’ alongside a stagnating corporate middle. His proposed solution is smaller and/or more limited government although the essay doesn’t explain how this will be achieved in practice. Presumably, that is in his forthcoming book.

- Also from the Weekend FT, a nice piece from columnist Janan Ganesh on the UK’s conservative dilemma, which highlights the in-built tension between a belief in markets and a belief in tradition.

- Brad DeLong does a deep dive into US Federal government debt.

- Fed Governor Christopher Waller has some thoughts on r* (which here he defines as the real policy interest rate that is neither stimulating nor restrictive with inflation at target). Waller identifies five key drivers that he argues pushed down r* before the pandemic, largely via the mechanism of an increase in the demand for safe assets (US Treasury securities): (1) the liberalisation and globalisation of capital markets in the 1990s; (2) the large increases in official reserve holdings following the East Asian financial crisis; (3) the rise of Sovereign Wealth Funds as key international investors; (4) an ageing population saving for retirement; and (5) post-GFC financial regulations. In terms of the future, Waller reckons that with respect to (1) capital market liberalisation is yet to show any significant signs of reversal; that in the case of (2) and (3) central banks and SWFs have shown little sign of reducing their demand for traditional safe assets; (4) demographic ageing is set to continue and even accelerate; and (5) there is little sign of a major unwinding of the existing regulatory framework. Set against these arguments for expecting r* to be low in the future, Waller does worry about an increase in the supply of US Treasuries due to the US fiscal position, which could lead to a rise in r*.

- Regarding points (2) and (3) above, note that recent financial press headlines have drawn attention to China’s record sales of US Treasury and Agency bonds in the first quarter of this year. Beijing is reportedly diversifying into gold, in part to mitigate any vulnerability to US financial sanctions.

- The IMF has completed its Article IV Mission to China. The Fund has upgraded its forecasts for China’s growth by 0.4 percentage points for this year and next and has pencilled in five per growth in 2024 followed by 4.5 per cent in 2025. While noting that some of the forecast upgrade comes in response to recent policy measures, the IMF is not so keen on Beijing’s ‘use of industrial policies to support priority sectors’ which it warns could lead to ‘a misallocation of domestic resources and potentially affect trading partners.’

- A Rogoff and Yang journal article on Rethinking China’s growth.

- The McKinsey Global Institute on the race to deploy AI and raise human capital.

- This WSJ piece looks at the problem with behavioural nudges.

- An entertaining essay in Harper’s Magazine covering Michael Green and his critique of passive investing.

- A Fireside Chat with Sarah Hunter, RBA Assistant Governor (Economic). Audio only available at time of linking.

- The FT’s Unhedged podcast asks, Where’s the commercial property meltdown?

- The Odd Lots podcast discusses the economics of competition policy via a conversation with an economist at the US Department of Justice’s Antitrust Division and whether market signals can drive decarbonisation with Brett Christophers.

Latest news

Already a member?

Login to view this content