Last week’s surprisingly strong March quarter CPI reading served as a warning of one of the risks facing Australia’s central bank as it navigates the narrow path between inflation and recession. The message was that persistent price pressures in the (closely overlapping) services and non-tradable sectors of the Australian economy were threatening to retard the pace of disinflation by enough to test the central bank’s patience. This week provided some reinforcement to that story, with data from CoreLogic showing that the monthly rate of rental rises remained strong into April this year, running at 0.8 per cent over the month and down only modestly from the one per cent growth rate recorded in March 2024. (Recall that one of the drivers of that strong first quarter CPI result was a 2.1 per cent quarterly increase in rents, which have been rising at their fastest rate in 15 years.)

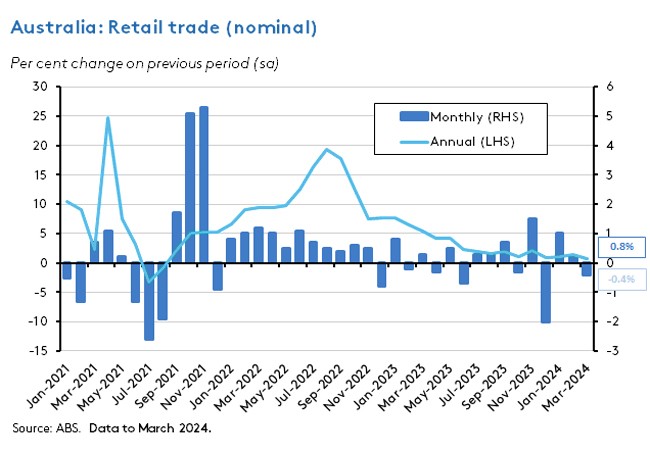

At the same time, however, this week also brought a reminder of some of the risks to be found on the other side of the RBA’s narrow path. Here, the message took the form of a softer than anticipated retail sales report. The market consensus forecast had expected retail turnover to rise 0.2 per cent over the month to March 2024. Instead, in a sign of economic weakness, turnover fell by 0.4 per cent month-on-month. Granted, retail numbers have shown some unusual seasonal patterns since the turn of the year, and this volatility makes interpreting monthly shifts more fraught than usual. Still, the fact that March turnover fell in all but one retail sector suggests that tight monetary policy and elevated cost-of-living pressures continue to squeeze Australian households, implying in turn that private consumption remains a significant downside risk to activity.

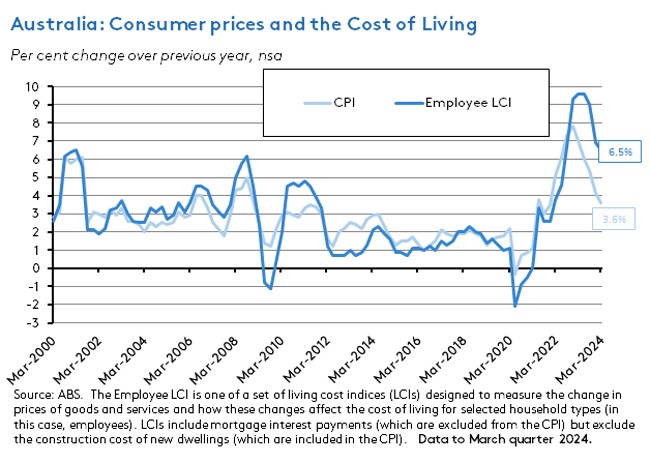

Another reminder of the vulnerability of households came this week in the form of updated Living Cost Indexes (LCIs) from the ABS. These confirmed that employee households in particular were still suffering from strong living cost increases, led by financial services in general and by mortgage and insurance payments in particular.

This same set of data also re-emphasises the dilemma facing the Treasurer as he prepares for the upcoming Budget. As we noted last week, with inflation still running above the top of the RBA’s target band, the macroeconomic scope for expansionary fiscal policy faces a significant constraint in the form of the monetary policy environment. At the same time, this week’s readings on elevated cost of living pressures and shrinking discretionary spending are potent reminders of the political pressures to deliver additional relief to households that are also in play. A key question here is will the political payoff from the already announced and reconfigured Stage 3 tax cuts be deemed sufficient? Moreover, the same macro constraint also applies to the government’s ambitions to deliver a new industrial policy bolstered by improved investment incentives (covered in the ‘Other things to note’ section below).

All of which means that Australia’s central bank and its Treasurer remain locked into the same balancing act that they have pursued for the past year. They need to stay on the tightrope. But the nature of the two-sided risks faced here mean there is no ‘fun’ for the spectators to be found in this macro-political version of funambulism.

Retail sales fall month-on-month in March 2024

The ABS reported that nominal retail trade fell 0.4 per cent over the month in March 2024 (seasonally adjusted) and was up just 0.8 per cent compared to March 2023. That means the monthly pace of growth has now slowed from one per cent in January to 0.2 per cent in February this year and then into contractionary territory.

The ABS noted that underlying retail turnover has now been flat for the past six months and that – with the exception of the pandemic period and adjustments associated with the introduction of the GST – this has been the weakest period of annual growth on record. March’s outcome was also weaker than the market had expected: the consensus forecast had expected a 0.2 per cent month-on-month rise.

Evidence of weakness was also visible in the fact that turnover was down in all industries this month, with the sole exception of food retailing (up 0.9 per cent). The largest declines were recorded in Clothing, footwear and personal accessory retailing (a 4.3 per cent drop) and Department stores (down 1.6 per cent) although the Bureau said some of this reflected payback from the large rises recorded by the two industries in February, with a ‘Taylor Swift-inspired boost in turnover for fashion and accessory retailers’ proving to be temporary and rapidly reversed. Monthly falls were also recorded for Household goods retailing (down 1.4 per cent), Other retailing (down 0.3 per cent) and Cafes, restaurants and takeaway food services (down 0.2 per cent).

Retailers told the ABS that overall trading conditions were challenging and that consumers were cautious in their discretionary spending, as households continue to be squeezed by cost-of-living pressures (see next story). Even Australia’s rapid rate of population growth now seems to be struggling to support aggregate retail spending.

Cost-of-living pressures ease in annual terms but remain elevated

Over the year to the March quarter 2024, the ABS said all five of its Living Cost Indexes (LCIs) rose between 3.3 per cent and 6.5 per cent, while all LCIs recorded larger quarter-on-quarter increases in the March quarter of this year than in the December quarter of 2023. Annual increases were lowest for the Age Pensioner LCI (up 3.3 per cent over the year) and the Self-funded retiree LCI (up 3.4 per cent) and highest for the Employee LCI (up 6.5 per cent).

The Employee LCI captures living costs for employee households, whose primary source of income is wages and salaries. Living costs for these households rose 1.7 per cent over the quarter, up from a 1.1 per cent quarterly increase in the previous December quarter. The latest increase was driven by mortgage interest rate charges (up seven per cent in quarterly terms compared to 5.4 per cent in the previous quarter – reflecting both the impact of the RBA’s November 2023 rate hike and the ongoing rollover off expired fixed rate loans to higher variable rate ones), as well as by education-related prices (up 5.4 per cent). All households also saw higher prices for medical and hospital services, higher insurance prices and higher food and non-alcoholic beverage prices.

In annual terms, the rate of increase for the employee LCI has eased from a peak of 9.6 per cent in the March and June quarters of last year to a still strong 6.5 per cent in the March quarter of this year. That is well above the annual rate of increase in the CPI, which rose 3.6 per cent last quarter. That gap mainly reflects the increase in mortgage interest charges, which surged 35.3 per cent over the year, albeit down from a peak of 91.6 per cent in the June quarter 2023. Insurance costs were also up by more than 17 per cent over the year in the March quarter of this year.

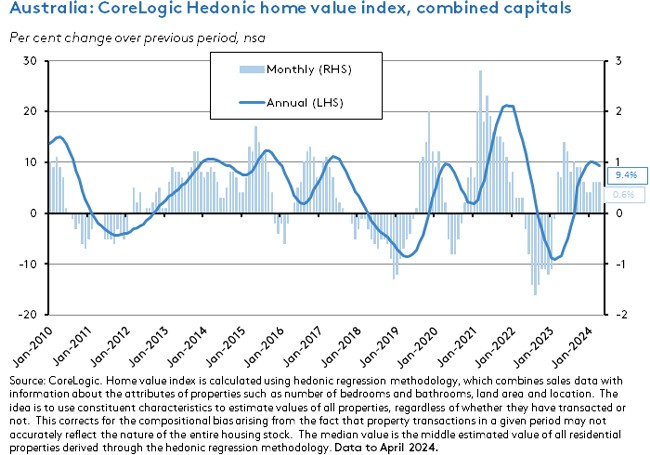

Australian house prices keep on rising

CoreLogic said its national Home Value Index (HVI) rose 0.6 per cent over the month in April 2024 to leave the index up 8.7 per cent over the year. The HVI has now risen for 15 months and national housing values have increased by 11.1 per cent (about $78,000) since they last hit a trough back in January 2023. April’s robust rate of monthly growth was also unchanged from the February and March 2024 outcomes.

The combined capitals index was also up 0.6 per cent in monthly terms and was 9.4 per cent higher over the year. Here, CoreLogic pointed to a multi-speed property market, with strong monthly gains in Perth (up two per cent), Adelaide (1.3 per cent) and Brisbane (0.9 per cent) alongside more modest growth in Sydney (0.4 per cent), Hobart (0.3 per cent) and Canberra (0.2 per cent) and a slight decline in Melbourne (down 0.1 per cent).

While values overall are still trending upwards, the data provider noted that sales look to have hit their cyclical peak last November, constrained by worsening affordability.

CoreLogic attributed the ongoing resilience of house prices in the face of high interest rates, weak consumer spending and squeezed household incomes to an ongoing shortfall in housing supply relative to demand, noting, for example, that while the year to September 2023 saw around 174,000 dwelling completions, underlying demand for dwellings is running at around 264,000 (derived from population growth divided by average household size of 2.5 people).

The national pace of growth in rents eased to a still strong 0.8 per cent month-on-month in April, down from one per cent in March and 0.9 per cent in February.

Ahead of the Budget, the fiscal position continues to outperform

Last Friday, the March 2024 Monthly Financial Statements from the Department of Finance reported that the underlying cash balance for the 2023-24 financial year to 31 March was a deficit of $1.8 billion. That compares to a MYEFO profile which had projected a deficit of $5.9 billion. The deficit undershoot reflects payments over the year to date running behind their MYEFO profile ($490.2 billion actual vs $494.9 billion projected). Receipts over the financial year to March were actually slightly below their MYEFO profile ($488.4 billion vs $489 billion).

The MYEFO had projected a narrow underlying cash deficit of $1.1 billion for the 2023-24 financial year, so latest numbers suggest that the Government is on track to be able to announce a second consecutive annual budget surplus. If it does so, this will be the first time Australia has been able to run a sequence of surpluses on the underlying cash balance since the period between 2002-03 and 2007-08.

What else happened on the Australian data front this week?

The ABS said total dwellings approved in March 2024 rose 1.9 per cent over the month (seasonally adjusted) to 12,947. That was down 2.2 per cent on the number of approvals recorded in March 2023. Approvals for private sector houses were up 3.8 per cent over the month and 7.3 per cent over the year, while approvals for private sector dwellings excluding houses rose 3.6 per cent month-on-month, but fell 16.8 per cent year-on-year. The Bureau also reported that average approval value for a new house continued to rise in annual terms, reaching $468,800 per house in March this year, adding that higher construction costs continue to weigh on dwelling approvals.

The seasonally adjusted balance on goods trade fell $1.6 billion to a surplus of $5 billion in March 2024. The ABS said goods exports were almost flat (up just 0.1 per cent) over the month, while goods imports rose by 4.2 per cent or $1.6 billion. The increase in imports reflected an eight per cent rise in capital goods, driven by a 32 per cent $342 million) jump in imports of automatic data processing (ADP) equipment; a four per cent rise in consumption goods, mostly driven by a 14 per cent (increase in imports of food and beverages and a four per cent rise in intermediate and other merchandise goods, reflecting a seven per cent increase in processed industrial supplies.

According to the ABS, Australia’s balance on goods and services trade was a surplus of $144.3 billion in calendar year 2023. Total goods and services exports rose 0.3 per cent ($1.8 billion) to $671.1 billion, while total goods and services imports rose 2.6 per cent ($13.5 billion) to $526.8 billion. After running a deficit on services trade of $20.8 billion in 2022, Australia recorded a small surplus of $0.7 billion last year, reflecting large rebounds in exports of education-related travel (up by $21.2 billion or almost 80 per cent) and other personal travel (up by $11.1 billion or more than 147 per cent). Total travel services exports hit a record high in 2023.

The ABS also released new data on Australia’s international investment position at December 2023. Foreign investment in Australia last year rose $62.8 billion to $4,659.9 billion, while Australian investment abroad climbed by $170.3 billion to $3,822.9 billion.

The ANZ Roy Morgan Consumer Confidence Index rose by 0.8 points to 81.1 for the week ending 28 April 2024. All four financial and economic subindices improved this week, although the index remained below the 85 reading for a record 65th consecutive week. Weekly inflation expectations rose to 5.3 per cent from five per cent the week before, perhaps reflecting the stronger than expected March quarter 2024 CPI data.

Last Friday, the ABS published updated international trade price indexes for the March quarter 2024. The export price index fell 2.1 per cent over the quarter to be 8.3 per cent lower over the year, while the import price index fell 1.8 per cent over the quarter and dropped 0.7 per cent over the year. The Bureau highlighted ‘unprecedented falls in price’ for lithium exports as a key driver of the former.

Other things to note . . .

- The latest Deloitte Access Economics Budget Monitor says the government is likely to deliver a second budget surplus in 2023-24, pencilling in an underlying cash surplus of $13.4 billion for the current financial year. Credit is given to higher-than-budgeted company and income tax receipts and the government’s restraint in not spending these gains. But the Monitor also reckons that this second consecutive surplus is likely to be the last in the current sequence, predicting a $7.9 billion deficit in 2024-25 followed by a $20.4 billion shortfall in 2025-26.

- The Treasurer’s speech this week to the Lowy Institute on Economic security and the Australian opportunity in a world of churn and change argued Australia could be ‘a primary beneficiary of a changing and churning global economy, just like we were primary beneficiaries of the calm that preceded it.’ He said when Australia is ‘facing the most challenging strategic environment since World War II, economic resilience is an essential component of assuring our national security’. And that as result, this year’s Budget would include ‘a greater emphasis on…National security and economic security.’ In the context of the government’s Future made in Australia policy, this approach will involve 'a case for targeted, temporary support to crowd in private investment – especially in industries that meet strict criteria.’ Those criteria include two investment streams – a national interest stream and a net zero transformation stream – and five tests, set out in the speech. The Treasurer also said the approach would mean Australia would upgrade its growth model and to this end the Budget ‘will have a big emphasis on attracting and deploying investment from the private sector’ with ‘financial incentives, regulatory changes and other enablers’, along with measures to reform Australia’s foreign investment framework.

- Related, a press release from the Treasurer on reforms to Australia’s foreign investment framework. The Treasurer is promising a risk-based approach to reviewing foreign investment proposals intended to make the approach stronger (more resources to screen investments in critical infrastructure, critical minerals, critical technology, sensitive data sets and investment in close proximity to defence sites), more streamlined (aiming to provide faster approvals for known investors making investment in non-sensitive sectors and with a good compliance record) and more transparent (in the form of an updated foreign investment policy document).

- The updated Foreign Investment Policy referenced above.

- The Economic Inclusion Advisory Committee 2024 Report. The report’s five key recommendations are that the government should (1) substantially increase JobSeeker and related working age payments and also improve the associated indexation arrangements; (2) increase the rate of Commonwealth Rent Assistance; (3) create a new employment services system; (4) implement a national early childhood development system; and (5) renew the culture and practice of the social security system to support economic inclusion and wellbeing.

- Related, one of the committee members, Peter Whiteford, makes the case for a budgetary boost to JobSeeker Payments.

- Also related, the ACOSS-UNSW report on Inequality in Australia 2024. On income inequality, the report says the highest 10 per cent of households ranked by income had an average after-tax weekly income that was more than two and half times larger than the income of the middle 20 per cent and seven times larger than the income of the lowest 20 per cent. On wealth inequality, the report reckons the highest 10 per cent of households ranked by wealth possess 44 per cent of all wealth in Australia. That is 15 times larger than the wealth of the lowest 60 per cent and 126 times the wealth of the lowest 20 per cent.

- CoreLogic looks at the relationship between (internal and external) migration rates and housing market trends, noting that the biggest short-term impact of overseas migration shows up in the rental market.

- Ian Douglas has some thoughts as to why new budget airlines always struggle in Australia. He emphasises small market scale, limited capacity at and access to key airports – particularly Sydney, unhelpful geography in the form of a linear East coast market, and strong incumbents.

- A new report from the Grattan Institute: Keeping the lights on: How Australia should navigate the era of coal closures and prepare for what comes next. Podcast version on how Australia can navigate a post-coal future.

- Two new research papers from the Productivity Commission. The first is on modelling Asian trade integration and the second considers advances in measuring health care productivity.

- The PBO updates its Budget Explainer on The Contingency Reserve to include the impact of the pandemic. COVID-19 saw the reserve increase to a record level of $57 billion or 2.7 per cent of Australia’s GDP in 2020-21.

- The AFR’s Karen Maley asks, Are we about to witness a rerun of the Asian financial crisis?

- The FT on how Japan is feeling the fallout from a US Fed shift to ‘higher for longer’ policy rates. And an FT Big Read on why China’s Xi Jinping is afraid to unleash China’s consumers.

- Tyler Cowen explains why he doesn’t think Japan will be suffering from a financial crisis anytime soon.

- The IMF’s Regional Economic Outlook for the Asia Pacific. Summary blog post.

- A WSJ long read examines how Beijing is bracing for a Trump vs China rematch.

- A selection of three interesting columns from the Centre for Economic Policy Research (CEPR)’s VoxEU policy portal: One on the promises and pitfalls of a green supply chain which looks at the challenges posed by ‘greenwashing’; one on the fallout of Red Sea disruptions for global trade and inflation which finds only muted effects due to spare capacity in global shipping, little port congestion, healthy global inventory levels and subdued global demand; and finally, a look at changing central bank pressures and inflation which argues that ‘a growing tension between central banks and democratically elected politicians can make low and stable inflation more difficult to achieve in the future.’

- The Economist magazine’s Free Exchange column asks, Is inflation morally wrong?

- Also from the Economist, a look at the rich world’s immigration boom (this was one of the topics we dived into in the latest Dismal Science podcast – recorded the day before this was published).

- The World Bank latest Commodity Markets Outlook.

- How new US and European actions on TikTok and Chinese subsidies are rewriting the Western policy playbook (Peterson Institute).

- The OECD’s Taxing Wages 2024 reports that effective tax rates on labour incomes rose across the majority of OECD members, with the post-tax income of single workers earning the average wage declining in 21 out of 38 countries. In most cases, this reflected increases in personal income tax as high inflation pushed workers into higher tax brackets. The data for Australia show that between 2022 and 2023 the real wage before tax fell by 1.6 per cent at the same time as the average personal tax rate rose by 7.6 per cent.

- On the perils of historical parallels: What would Thucydides say?

- The FT’s Behind the Money podcast on how shale rewrote the global oil order.

- The Past Present Future podcast talks to Helen Thompson about the Gold Standard and asks, does the Gold Standard belong in the series’ list of history’s bad ideas?

Latest news

Already a member?

Login to view this content