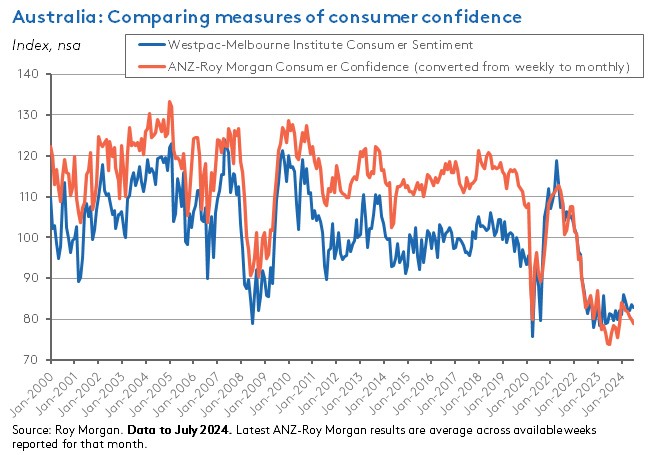

This week’s two updates on consumer sentiment painted a familiar picture, with confidence readings still stuck at recession-like levels. The monthly Westpac-Melbourne Institute Consumer Sentiment Index went backwards in July as households’ gloom about their financial position intensified. And the weekly ANZ-Roy Morgan Consumer Confidence Index unwound most of the previous week’s increase as consumers put a short-lived lift from the End of Financial Year sales behind them. Both results suggest that the cost-of-living relief sitting at the heart of Budget 2024-25 is yet to gain any significant traction with households, although it is important to note that it is still early days.

Other data releases this week reported that current business conditions softened in June, even as forward-looking confidence increased; and after a COVID-era jump, labour mobility has now returned to its pre-pandemic levels.

More detail below.

Consumer sentiment still very weak

The Westpac-Melbourne Institute Consumer Sentiment Index fell 1.1 per cent to an index reading of 82.7 in July 2024. According to Westpac, the various subcomponent indices show that the fall in confidence was mainly driven by a deterioration in sentiment around family finances. Thus the ‘family finances vs a year ago’ subindex dropped by 8.4 per cent, unwinding much of last month’s 9.7 per cent gain. Similarly, the ‘family finances, next 12 months’ subindex fell 4.5 per cent and returned its softest result since the end of last year. Taken together, the two finance subindices are down to their weakest level since November 2023. In contrast, other subcomponents improved this month, with consumers feeling slightly better about the economic outlook and the time to buy a major household item.

Westpac interpreted the overall July results as indicating that the impact on households from persistent inflationary pressures and fears of future interest rate rises are still outweighing any lift from the arrival of the revised stage 3 tax cuts and the other fiscal support measures in Budget 2024-25. It did also comment, however, that many households would not yet have seen a positive cashflow impact, given that payment cycles for incomes and for electricity and rent support would often be fortnightly or monthly.

Another noteworthy result from this month’s survey findings was a big (12.8 per cent) jump in the Westpac-Melbourne Institute Mortgage Rate Expectations Index, which recorded its steepest monthly rise since the question was first asked at the start of 2022. Currently, just under 60 per cent of consumers expect mortgage rates to rise over the coming year. In contrast, expectations around the labour market and prospects for the unemployment rate remain relatively upbeat.

Meanwhile, the weekly ANZ-Roy Morgan Consumer Confidence Index fell 2.3 points to an index reading of 79 in the week ending 7 July 2024. That weekly drop took the index back to below 80 and down to its second lowest level this year. The fall was driven by a nine-point slump in the ‘time to buy a major item’ subindex (the largest fall for that measure since February last year) in what was likely a response to the finish of End of Financial Year sales. By housing component, the fall in confidence was largest for those paying off a mortgage, which ANZ reckoned could also reflect recent discussion of the potential for another RBA rate hike.

Overall, then, both the Westpac-Melbourne Institute and the ANZ-Roy Morgan measures of consumer confidence remain at extremely low levels, despite the scheduled arrival of Budget 2024-25 relief.

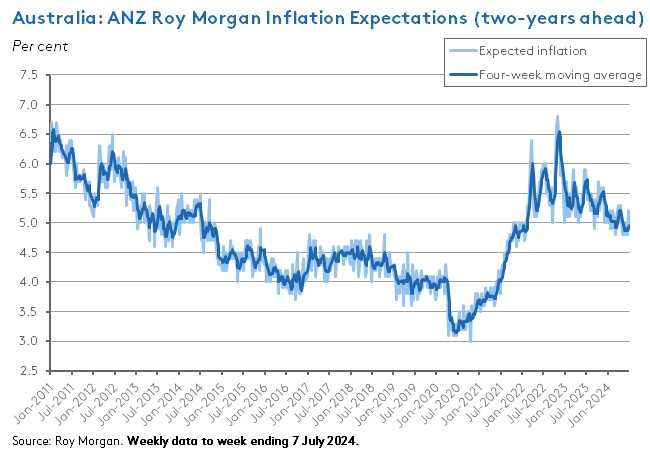

The ANZ-Roy Morgan ‘weekly inflation expectations’ index eased to a reading of 4.9 per cent last week, down from the previous week’s two-month high reading of 5.2 per cent.

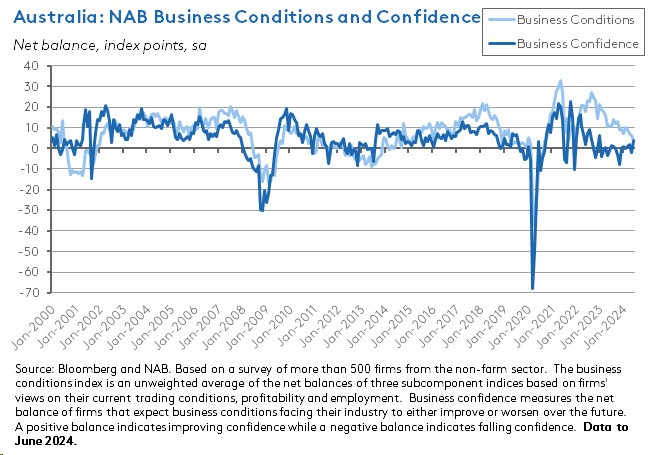

Business conditions and confidence diverge in June

The June 2024 NAB Monthly Business Survey reported that business conditions fell two points to an index reading of +4 index points last month. Although that left conditions in positive territory, it also means they are now well below their long-run average. The decline in conditions reflects drops in trading (down from +11 to +10 points), profitability (down from +3 to +2 points) and employment (down from +5 points to 0) subindices.

In contrast, the level of business confidence rose by six points in June to +4 index points, achieving that index’s highest level since early 2023. Forward orders were flat at -7 index points, while the capacity utilisation rate was a little higher at 83.5 per cent, up from 83.3 per cent in the previous month.

After a disappointing set of results in May 2024, there was some relatively positive news on the cost front last month. Labour cost growth fell to 1.8 per cent from 2.3 per cent (at quarterly equivalent terms); growth in purchase costs slowed from 1.7 per cent to 1.3 per cent; and growth in final product prices dropped from 1.1 per cent to 0.7 per cent. However, retail price growth increased from 1.4 per cent in May to 1.5 per cent in June.

NAB reckoned June’s mixed set of survey results was consistent with the idea that although the pace of economic activity in continues to slow, at the same time the level of demand overall remains elevated relative to supply.

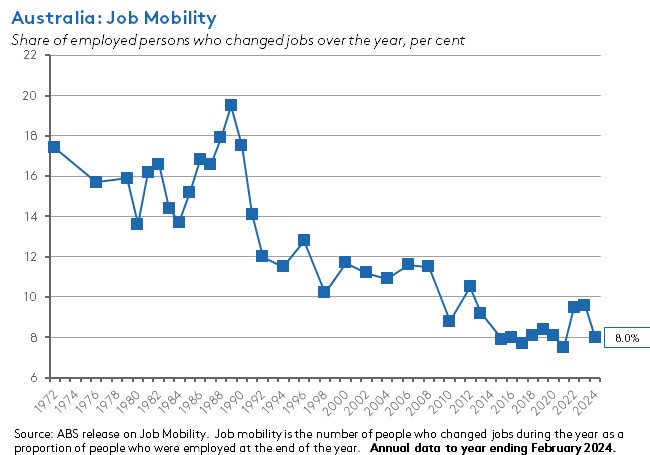

Job mobility back down to pre-pandemic levels

New ABS data on labour market participation, job search and mobility reported this week that 1.1 million people changed jobs during the year ending February 2024. That equates to a labour mobility rate of eight per cent of all employed people changing jobs during the year. That mobility rate is down from pandemic-era highs of 9.6 per cent in the year ending February 2023 and 9.5 per cent in the previous year and is more in line with pre-pandemic mobility rates.

Labour mobility can reflect both voluntary and involuntary job separations, where the former involves the independent decision of workers to leave a role and the latter is the consequence of decisions taken by employing firms. It includes both retrenchments and the end of temporary work. The same set of data showed that the annual retrenchment rate (the number of people retrenched each year as a share of the number employed at the start of the year) rose to 1.7 per cent in the year ending February 2024. That was up from the previous year’s record (since 1972) low of 1.4 per cent.

These mobility and retrenchment numbers are interesting for a couple of reasons.

First, they provide some evidence of cyclical conditions in the labour market, since all else equal, involuntary separations such as retrenchments tend to be negatively correlated with employment growth and the business cycle. That is, as the economy slows and demand for labour weakens, retrenchments would be expected to increase. In contrast, voluntary separations tend to be procyclical since workers tend to be more willing to accept the risks involved in changing jobs when labour market conditions are stronger.

Second, labour mobility is also seen as evidence of the extent of economic dynamism, with some pointing to the long pre-pandemic decline in labour mobility as evidence of declining dynamism and diminishing competition in the Australian economy.

What else happened on the Australian data front this week?

The ABS said the number of payroll jobs increased by 0.1 per cent over the month in the week ending 15 June 2024. Job numbers were also 1.6 per cent higher in annual terms. According to the Bureau, the rate of growth in payroll jobs has slowed from an annual rate of more than three per cent early in 2023-24 to around half that rate by mid-June this year, in line with a similar moderation in other labour market indicators.

The ABS’s Monthly Business Turnover Indicator fell 0.6 per cent over the month in May 2024 (seasonally adjusted) but was still up 1.6 per cent relative to May 2023. On a monthly basis there were falls in turnover for eight of the 13 industries in the aggregate series, led by declines in Administration and support services (down 2.3 per cent) and Wholesale trade (down 2.1 per cent). In annual terms there were increases for 11 of the 13 industries, led by Construction and by Information, media and telecommunications (both up 6.4 per cent) and Arts and recreation services (up 6 per cent).

In May 2024 new loan commitments for housing fell by 1.7 per cent over the month (seasonally adjusted) to $28.8 billion. According to the ABS, that was still up 18 per cent on commitments made in May 2023. New lending to owner occupiers was $18.1 billion, down 2 per cent over the month but 12.2 per cent higher in annual terms, while new lending to investors was $10.7 billion, down 1.3 per cent over the month and up 29.5 per cent year-on-year.

Released last Friday, the latest ABS Monthly Household Spending Indicator shows household spending was flat over the month and up 0.1 per cent over the year (current price, calendar-adjusted basis) in May 2024. Spending on services was up 2.3 per cent in annual terms, while spending on goods was down 2.5 per cent. Spending on non-discretionary items – led by expenditure on health services and food – was up 1.8 per cent relative to May 2023, while spending on discretionary items was down 1.9 per cent over the same period.

Other things to note . . .

- New research from the Productivity Commission (PC) looks at economic mobility in Australia. The research considers three dimensions of economic mobility: Mobility over the course of an individual’s lifetime; mobility from one generation to the next; and the chances of escaping poverty. Key findings include: Most Australians (67 per cent of those born between 1976 and 1982) earn more than their parents did at a similar age, with this particularly the case for those born in poorer families; Australia has relatively high levels of income mobility compared to many of our peers including Scandinavian countries; and although there is substantial mobility across the income distribution, there is some persistence at the top and bottom deciles. The PC also warns that while overall mobility in Australia is high, there are ‘worrying signs’ that people in poverty face ‘particular difficulties in moving up the income distribution’ at a time when Australia’s poverty rate has been rising over the past two decades to its highest level since 2001 (albeit with a break in that trend during the pandemic).

- Also from the PC, the latest report on National Water Reform.

- A new RBA Research Discussion Paper on Nowcasting quarterly GDP growth during the pandemic.

- ABC Business discusses efforts to extend money laundering laws to Australia’s real estate sector.

- Three new reports from the OECD. First, Employment Outlook 2024 finds that across the OECD total employment is now above its pre-pandemic level, while the unemployment rate is close to its lowest level since at least 2001. At the same time, however, real wages have recovered to pre-pandemic levels in only 19 of the 35 OECD members with available data. In Australia, real wages are still 4.8 per cent lower than in Q4:2019 and this represents one of the largest drop in real wages across OECD countries. Similarly, as of May this year (before the latest FWC increase) the 2.3 per cent real increase in the minimum wage in Australia was less than in most OECD countries and well below the median increase of 8.3 per cent. The same report also includes an assessment of the labour market impact of the transition to net zero emissions by 2050. According to the report, across the OECD about 20 per cent of the workforce is employed in ‘green-driven’ occupations (20.9 per cent in Australia) compared to about seven per cent in greenhouse gas-intensive sectors (also seven per cent). But workers in high-emissions sectors face large potential earnings losses after job displacement – an average of a 36 per cent fall over six years after job loss (compared to 29 per cent in Australia) vs 29 per cent in other sectors (25 per cent in Australia).

- Second, the OECD-FAO Agricultural Outlook 2024-25 says that over the past 20 years, emerging economies have increasingly driven global agricultural and fisheries market developments, reflecting the combined impact of population growth and rising incomes. Resulting shifts in agricultural production and consumption have also led to changes in trade patterns. Interestingly, the report notes that in relative terms, China’s influence on global consumption is now waning relative to that of India and Southeast Asia. While China contributed 28 per cent of global consumption growth over the past decade, its share of additional demand over the coming decade is projected to fall to 11 per cent, while India and Southeast Asia are together expected to account for 31 per cent of global consumption growth.

- And third, an OECD survey on drivers of trust in public institutions reports that as at November 2023, 44 per cent of people across OECD countries had low or no trust in their national government, vs 39 per cent who said they had high or moderately high trust. In the case of Australia, about 38 percent of respondents reported low or no trust in the federal government (below the OECD average) while 46 per cent reported high or moderately high trust in the federal government (above the OECD average and up from eight percentage points since 2021 in the third highest increase across OECD countries with available data).

- An FT Big Read on how the investment world is trying to navigate geopolitics.

- Also from the FT, Martin Wolf on new UK Prime Minister Keir Starmer’s difficult choices.

- Related, the latest IMF Article IV and Selected Issues Reports for the UK.

- On layoffs, retirement, and post-pandemic inflation (US data).

- The WSJ argues that new governments in the UK and France face a poisoned chalice in the form of near-multidecade high public debt burdens.

- The Economist magazine analyses what went wrong with Boeing.

- David Wengrow reckons that we’ve been getting ancient demographic and population estimates wrong.

- The FT’s Unhedged podcast considers what recent elections in France and the UK mean for markets.

- Two interesting episodes of the Odd Lots podcast. First, a conversation with Dan Davies on his new book The Unaccountability Machine: Why Big Systems Make Terrible Decisions and second a discussion with Warren Mosler, one of the founders of Modern Monetary Theory (MMT) on debt, interest rates and inflation.

Latest news

Already a member?

Login to view this content