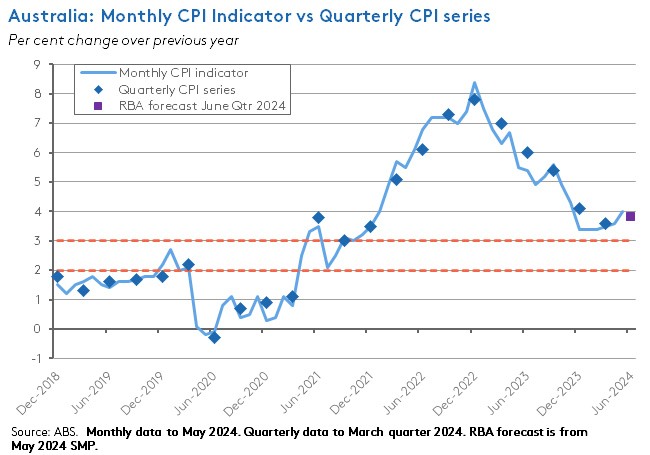

Another month and another disappointingly high inflation reading. The monthly CPI Indicator for May 2024 printed at an annual rate of four per cent. That was above April’s reading of 3.6 per cent and above market expectations for a 3.8 per cent print. The two monthly measures of underlying inflation both had a ‘four’ in front of them, plus there were also some worrying signs that previously helpful developments in goods and tradables inflation have stalled, even as services and non-tradables inflation continue to demonstrate ongoing persistence.

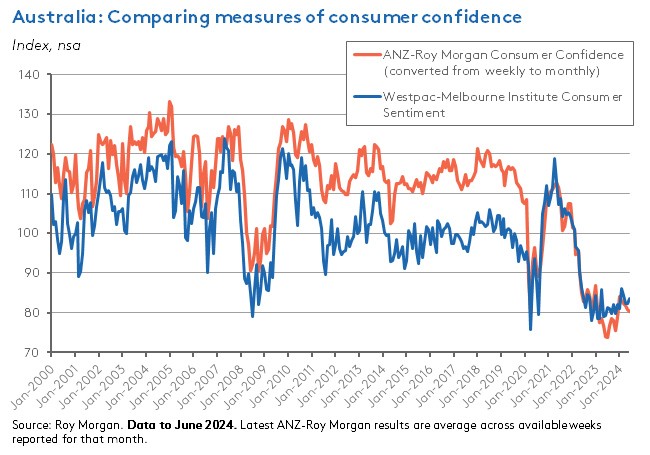

There are upside risks to the RBA’s forecast for 3.8 per cent headline and underlying inflation outcomes for the June quarter of this year. That’s important because as discussed last week, while my base case calls for no change in the cash rate target through the rest of this year, I’ve also acknowledged that a large-enough upside surprise to inflation could yet end up forcing the central bank’s hand. Or, put differently, yet more evidence of a narrowing of the RBA’s narrow path. Elsewhere this week, we received updated reads on consumer sentiment. The monthly Westpac-Melbourne Institute Consumer Sentiment Index edged higher in June but remains deep in negative territory, as does the Weekly ANZ-Roy Morgan Consumer Confidence Index. Meanwhile, ABS data on job vacancies reported an eighth consecutive quarterly fall in vacancy numbers in May this year. Vacancies are now down 26 per cent from their peak, albeit still comfortably above their pre-pandemic levels.

More detail below along with the usual linkage roundup. I am on the road next week, so the forthcoming weekly update might end up as an abbreviated version.

Monthly CPI indicator up four per cent over year to May 2024

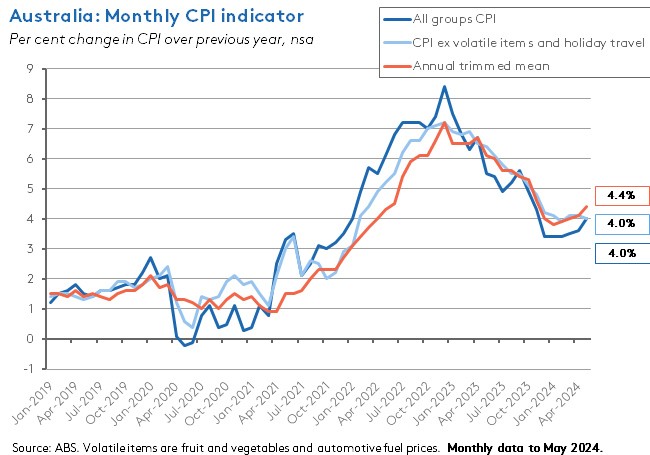

The ABS reported that its monthly Consumer Price Index (CPI) Indicator rose four per cent over the 12 months to May 2024. Not only was that up on April’s 3.6 per cent print, but it was also above the market consensus forecast of a 3.8 per cent outcome and was the highest annual reading since November 2023.

According to the Bureau, by group the most significant contributors to last month’s annual rise were Housing (up 5.2 per cent), Food and non-alcoholic beverages (up 3.3 per cent), transport (up 4.9 per cent) and Alcohol and tobacco (up 6.7 per cent):

- The rise in the housing group was driven by a 7.4 per cent annual increase in rents (down slightly from 7.5 per cent in April) and a 4.9 per cent rise in new dwelling prices (unchanged from the previous month). Another important contributor was a 6.5 per cent increase in electricity prices (up from 4.2 per cent in April), with the ABS noting that out-of-pocket costs were gradually increasing as the Energy Bill Relief Fund rebates introduced from July 2023 have been progressively used up by eligible households. Without that relief, electricity prices would instead have risen 14.5 per cent last month.

- The increase in the rate of annual inflation for Food and non-alcoholic beverages slowed to 3.3 per cent in May from 3.8 per cent in April. The largest contributor here was Meals out and takeaway foods, which rose 4.2 per cent over the year last month compared to 5.4 per cent in April.

- For the Transport group, the largest driver of price action was Automotive fuels. In monthly terms, the latter fell 5.1 per cent in May, recording a first monthly decline since January this year. Even so, the annual increase was a strong 9.3 per cent, up from 7.4 per cent in April, thanks to base effects (a smaller monthly fall in May 2024 relative to May 2023).

- In the Alcohol and tobacco group, there were increases in the annual rate of inflation for both alcohol (up to 3.4 per cent from 3.1 per cent) and tobacco (up to 13.4 per cent from 13 per cent).

Other price developments also worth noting included an increase in the annual rate of Holiday travel and accommodation inflation, which after falling by 6.2 per cent in April rose by 2.9 per cent over the year in May, despite recording a 2.7 per cent monthly decline, and a slight easing in the (still-elevated) rate of annual inflation for Insurance and financial services, from 8.2 per cent in April to 7.8 per cent in May.

Measures of underlying inflation painted a mixed picture last month. On the one hand, there was some modest positive news in that the annual rate of increase in the CPI excluding volatile items (fruit and vegetables and automotive fuel) and holiday travel eased slightly from 4.1 per cent in April to four per cent in May. On the other hand, yearly growth in the annual trimmed mean increased from 4.1 per cent to 4.4 per cent. At best, that suggests core inflation is currently stuck above four per cent.

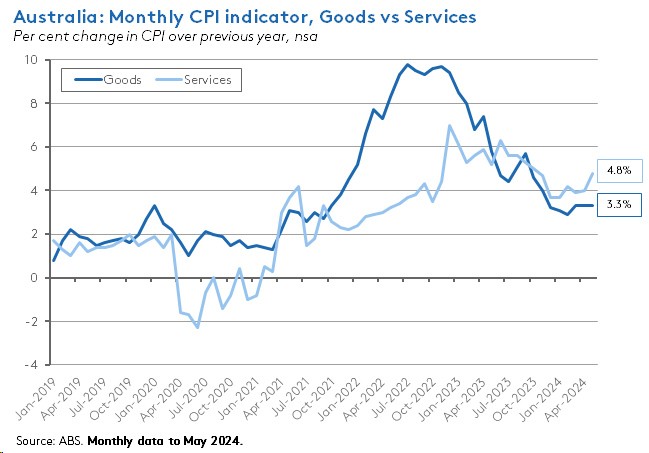

Meanwhile, the CPI analytical series failed to provide much comfort, either. The split between goods and services inflation showed the rate of services inflation ticking up to 4.8 per cent in annual terms, while disinflation in goods prices is showing signs of a stall, having been unchanged at 3.3 per cent for the past three months.

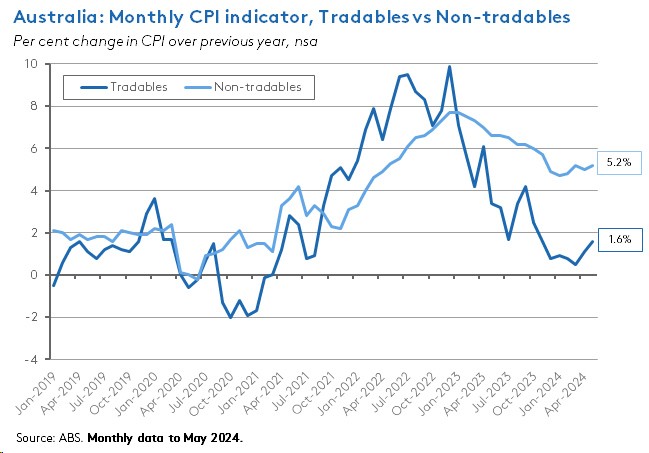

Similarly, while non-tradables inflation remained elevated at 5.2 per cent over the year, the previous progress with disinflation in tradables showed some early signs of unwinding, climbing to a (still relatively subdued) 1.6 per cent.

This is the point at which it has become compulsory to remind readers that the RBA does not place nearly as much weight on the monthly CPI indicator as it does on the quarterly CPI – a message that was again reiterated by the RBA Governor in her post-meeting press conference earlier this month when she said of April’s unexpectedly high monthly CPI indicator: ‘It’s only a monthly CPI, it doesn’t give you a full picture of things.’ Governor Bullock then went on to acknowledge that the CPI for the June quarter was going to be important in judging the trajectory of inflation. Those June quarter numbers will be published on 31 July. That will be in time to be considered at the next Board meeting which will be held over 5-6 August.

In its latest (May 2024) set of forecasts, the RBA said it expects both the headline rate of inflation and the trimmed mean rate of inflation to come in at 3.8 per cent. May monthly numbers indicate the presence of upside risk to that prediction.

What else happened on the Australian data front this week?

The ABS said total job vacancies were 352,600 in May 2024 (seasonally adjusted), down 2.7 per cent or 10,000 vacancies from February this year and 17.7 per cent lower than in May 2023. Private sector vacancies were 313,500 (down 2.7 per cent from February 2024 and 17.8 per cent lower than their May 2023 level), while public sector vacancies were 39,100 (down 2.5 per cent from February 2024 and down 16.5 per cent from May 2023). Still, even after eight consecutive quarters of falling vacancy numbers and a cumulative drop of 26 per cent from their May 2022 peak, the level of vacancies remains 54.8 per cent or around 125,000 vacancies higher than in February 2020, before the pandemic.

The Westpac-Melbourne Institute Consumer Sentiment Index rose to 83.6 in June 2024, up 1.7 per cent from May’s 82.2 reading. Despite the increase, the index remains below its March 2023 level and is well below a ‘neutral’ reading of 100. Westpac said two news topics stood out in their June results‘ - budget and tax’ and ‘inflation’ and commented that a positive impact on sentiment from fiscal support measures was being negated by increased concerns about inflation and the outlook for interest rates. For example, while the ‘family finances vs a year ago’ subindex rose by a strong 9.7 per cent in June, in level terms it remained deep in negative territory at just 69.3. At the same time, the ‘economic outlook, next 12 months’ subindex fell 5.7 per cent to 78.5 and its lowest level since last October, suggesting consumers are becoming more worried about near-term prospects. Interestingly (and providing a somewhat different read than the weekly ANZ-Roy Morgan confidence measure discussed below), Westpac said responses over the course of the survey week showed sentiment deteriorating materially following last week’s RBA meeting. Sentiment amongst those surveyed pre-meeting was 90 compared to 80.1 amongst those surveyed post-meeting. That pessimism is reflected in expectations around interest rates, with the Westpac-Melbourne Institute Mortgage Rate Expectations Index (which tracks expectations for variable rate mortgage rates over the next 12 months) rising to its highest level since the start of the year: about half of respondents expect mortgage rates to rise over the year ahead.

The ANZ-Roy Morgan Australian Consumer Confidence Index was little changed in the week ending 23 June 2024, up just 0.1 points from the previous week to a reading of 80.4 points. The index has now spent a record 73 consecutive weeks below a reading of 85. ANZ economists said the result suggests last week’s decision by the RBA to leave the cash rate target unchanged had little impact on household sentiment. There was an increase in the time to buy a major household item subindex, which rose to its highest level since late January. ANZ reckoned this could be linked to a ramp up in end-of-financial year sales events. Weekly inflation expectations fell 0.1 percentage points to 4.8 per cent.

The ABS published the National Accounts: Finance and Wealth for the March quarter 2024. According to the Bureau, household wealth rose for a sixth consecutive quarter, increasing by 2.7 per cent ($431 billion) to $16.2 trillion. That’s up $1.5 trillion or 10.2 per cent compared to the same quarter last year. Of that 2.7 per cent quarterly rise, an increase in the value of residential land and dwellings contributed 1.3 percentage points, while superannuation assets contributed a further 0.9 percentage points. Direct ownership of shares and other equity contributed another 0.4 percentage points. Household liabilities increased by 1.5 per cent or $44.3 billion over the quarter, driven by a $21.5 billion rise in housing loans (of which $17.2 billion related to owner-occupier lending and $4.3 billion to investor lending).

The ABS said the value of total engineering construction (seasonally adjusted, chain volume measure) in the March quarter 2024 was down 2.3 per cent over the quarter but up 6.6 per cent in annual terms. Private sector engineering work was down 2.2 per cent quarter-on-quarter and up 5.1 per cent year-on-year, while public sector work done was down 2.4 per cent quarter-on-quarter and up 8.4 per cent over the year.

The Judo Bank Flash Australia Composite PMI was released last Friday. The Composite Index fell to 50.6 in June 2024 from a reading of 52.1 in May, a five-month low. Private sector activity has been expanding for the past five months, although the latest reading shows the pace of that activity slowing. Once again, services drove overall growth, although the Flash Australia Services PMI Business Activity Index did dip to its own five-month low of 51 in June, down from 52.5 in May. The Flash Australia Manufacturing Output PMI returned another sub-50 reading indicating a decline in activity, with the index falling to a three-month low of 47.7, down from 49.2 in May. In some rare positive news on the inflation front, average input costs rose at their slowest pace in nearly three-and-a-half years, with the composite input price index falling below the 60 level for the first time since January 2021. Firms also lifted selling prices at a softer rate this month.

Other things to note . . .

- The June 2024 RBA chart pack.

- A speech by RBA Assistance Governor Chris Kent on Restrictive Financial Conditions in Australia. According to Kent, based on the median estimate of the nominal neutral rate, the current cash rate target is about one percentage point above neutral. Likewise, relative to a range of alternative indicators, financial conditions are currently ‘particularly restrictive for households, but less so for larger businesses.’ Tighter monetary policy is being felt ‘most directly by the roughly 40 per cent of Australian households with a mortgage’ who have seen their average interest rate rise by around 335bp to date, to stand at a little over six per cent. The expiration of most remaining low fixed rate mortgages through the end of this year will add another 20bp to the average outstanding mortgage rate. Scheduled principal and interest mortgage payments have risen to a record 10 per cent of household disposable income, although extra payments into mortgage offset and redraw accounts have also held up. Meanwhile, average rates on large business loans have increased by more than 425pb over the phase of monetary policy tightening, compared to an increase of around 310bp for small businesses (although in levels terms, the latter continue to face substantially higher interest rates). For many medium and large businesses, the effect of higher rates has been partly offset by strong nominal earnings, relatively low leverage (aggregate leverage is almost 10 percentage points lower than its pre-pandemic level) and (in some cases) debt that was issued at earlier low fixed rates. Most listed companies also hold cash buffers that are slightly higher than pre-pandemic levels.

- The Parliamentary Budget Office (PBO)’s Beyond the Budget 2024-25 report provides some reassurance on Australia’s fiscal outlook and sustainability. The PBO projects gross debt to fall from 33.9 per cent of GDP in 2024-25 to 30 per cent of GDP in 2034-35, despite continued budget deficits. It also finds that gross rent and interest payments as a share of GDP are expected to decline ‘in all but the worst-case scenarios’ by the end of the PBO’s analysis period. But the PBO also warns of risks to revenue (a continued and increasing reliance on personal income taxes; a faster-than-expected decline in excise revenues due to the take up of EVs) and expenditure (fiscal pressures arising from the impact of ageing on health; disability programs; defence; and climate change).

- Last week’s speech by Secretary to the Treasury Dr Steven Kennedy on Economic policy in a changing world. Related, an AFR piece uses the relationship between Kennedy and ONI director-general Andrew Shearer to lead into a discussion on how Canberra’s ‘spooks and economists’ are managing the economic and security relationship with China.

- Also from the AFR, Steven Hamilton and Luke Heeney argue that the economics of nuclear power don’t stack up for Australia. Related, the Australian Energy Market Operator’s 2024 Integrated System Plan for the National Electricity Market. Also related, a useful introductory guide from the OECD’s Nuclear Energy Agency (NEA) on system cost analysis and optimising the trade-offs between dispatchable low carbon sources of electricity such as nuclear energy and variable sources such as wind and solar photovoltaic.

- Papers from the ABS and RBA June 2024 Joint Conference on Human Capital.

- A new ANU report from the Centre for Social Policy Research looking at Budget 2024 and living standards trends in Australia. The authors find the impact of new budget measures contained in Budget 2024 for the 2024/25 financial year were generally spread across the income distribution, mainly due to the energy rebate. The other major cash measures were broadly progressive in nature. They say that on balance the lowest 80 per cent of the income distribution received similar assistance in dollar terms, while the top 20 per cent partly paid for this assistance through higher taxes than they would otherwise have paid under the previous government. In terms of overall living standards, the authors reckon these are little changed since December 2019 just prior to the pandemic. Middle income households have typically done worse than very high income or very low income households; mortgage households have done much worse than renters or those who own outright; older households have done much better than working age households; households whose main source of income is ‘other’ income have done better than those mostly reliant on either wages or government income; those who rely mostly on business income have done particularly badly since COVID-19; and families with children have experienced lower growth in living standards than those without.

- New ABS information from the 2022 National Health Survey, including seven new insights from state and territory data.

- ABS insights on migrant settlement outcomes.

- The IMF’s Gita Gopinath on navigating fragmentation, conflict, and large shocks with reference to the war in Ukraine. She argues that the direct global impact to date includes higher inflation, lower growth and higher defence spending, while the key indirect impact has been that the conflict has served as a turning point for global economic fragmentation, which could lead to lower productivity, lower income levels, an increased vulnerability to shocks and more inflationary pressures. She also discusses implications for policymakers.

- Also from the IMF, an attempt to estimate the cost of de-risking, reshoring, friend-shoring, and quality downgrading between China and OECD members. According to the estimates presented here, returning the level of global economic integration to 2000 levels would translate into long-term global GDP losses of 4.5 per cent under reshoring and up to 1.8 per cent under friend-shoring.

- Goodhart and Pradhan reckon we are at a turning point for monetary policy as we move into an era focused on debt management as debt becomes a permanent feature of the decades to come. One consequence is that in future central banks may need to raise policy rates quickly and lower them only slowly.

- The WSJ profiles economist David Autor. Autor’s work (with co-authors) on the shock to the US labour market delivered by trade with China is arguably some of the most influential economics output in recent decades in terms of helping reshape international economic policy debates and policy settings.

- The OECD’s Society at a Glance 2024 looks at fertility trends.

- The Economist magazine has an essay on solar power.

- The June 2024 edition of the Oxford Review of Economic Policy brings together a set of papers on the changing world order, global economic governance and liberal internationalism.

- The FT’s Big Read reckons companies are starting to back away from green targets.

- Also from the FT, Martin Wolf selects his best economics books for (Northern hemisphere) summer reading.

- Branko Milanovic on the life of Keynes contrasts Keynes’ views with that of the Austrian school.

- The Unhedged podcast asks, are we all protectionists now?

- The Conversations with Tyler podcast talks to Joseph Stiglitz.

Latest news

Already a member?

Login to view this content