This week brought business survey results for January 2022 and consumer confidence readings for February. Mostly, the data suggest that while the Omicron variant has – inevitably – taken a toll on economic activity and sentiment since the start of this year, the scale of that impact has been modest relative to the level of case numbers.

Business conditions have suffered but confidence is now improving after having slumped in December and although consumer confidence is down this month, it is still far from the severe lows seen in the first year of the pandemic. Both of this week’s consumer surveys also suggest that households are feeling wary about the state of their finances – perhaps spooked by higher prices and the prospect of higher interest rates following last week’s RBA meeting – and that this appears to have outweighed recent positive news on declining COVID case numbers and hospitalisations.

Also in this week’s note, a quick summary of other Australian data releases and the usual roundup of interesting links including our latest inflation chart pack, a briefing on the global savings glut, managing the debt legacy of the pandemic, why we need to worry about our new technologies being weaponised against us, and a chat with John Taylor about the Taylor Rule.

After an extended summer holiday, the Dismal Science podcast returns this week with a look at the inflation debate.

Listen and subscribe to our podcast: Apple Podcasts | Google Podcasts | Spotify

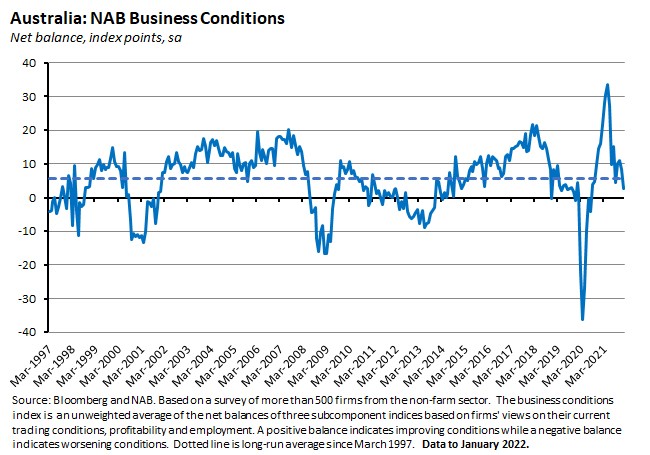

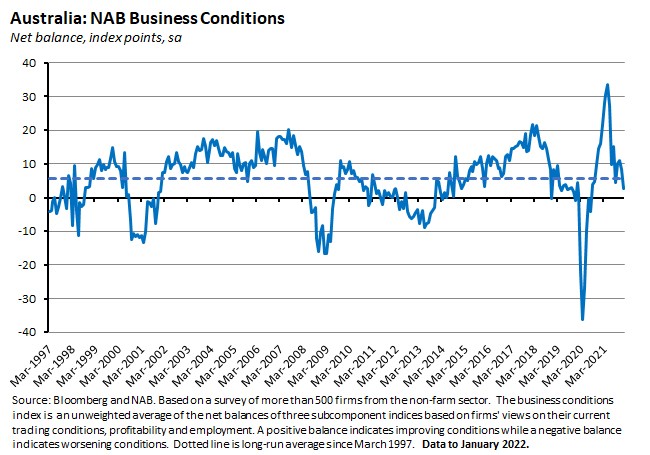

Business conditions slide but confidence rebounds

The NAB January 2022 Business Survey said that business conditions declined last month, dragged down by soaring COVID-19 case numbers and the consequent economic fallout. The conditions index fell five points over the month to an index reading of +3 points. That also took the index down below its long-run average although it remains above neutral. Notably, all three subcomponents of the conditions index worsened over the month, with large drops for profitability and trading conditions and a smaller fall for employment.

Business confidence in January moved in the opposite direction to conditions, with the confidence index jumping 15 points to +3 index points. That reversed a chunk of the 25-point slump in confidence recorded in December. Forward orders were largely steady last month while capacity utilisation moved higher.

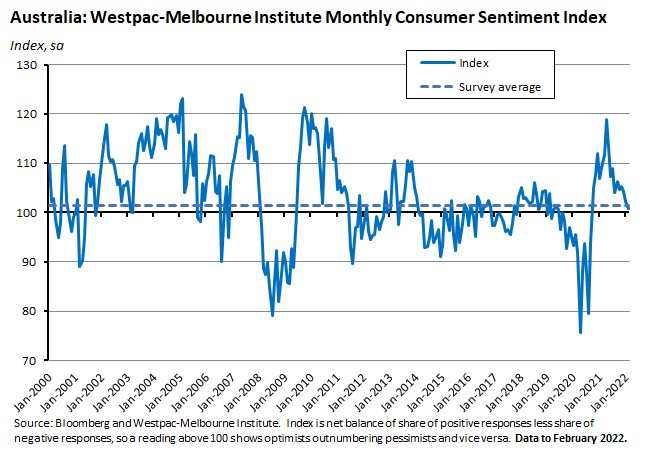

Meanwhile, consumers are feeling nervous

The Westpac-Melbourne Institute Index of Consumer Sentiment (pdf) fell 1.8 per cent in February this year after declining by about two per cent in January and one per cent in December 2021. That left the index at 100.8, which is both below the long-run series average and the lowest reading since September 2020, although it is worth noting that optimists continue to (narrowly) outnumber pessimists.

Westpac noted that falling COVID case numbers plus news of a strengthening labour market might have been expected to boost sentiment this month, all else equal. And there was evidence of some positive impact in improvements in the ‘economic conditions next 12 months’ and ‘economic conditions next five years’ subindices, both of which rose relative to last month. Likewise, there was also a sharp fall in the Westpac-Melbourne Institute Unemployment Expectations Index which dropped to its second lowest reading since February 2011, indicating that a growing number of survey respondents anticipate that unemployment will fall over the next 12 months.

However, this good news was more than offset by a big monthly drop in the ‘family finances vs a year ago’ subindex and a smaller slide in the ‘family finances next 12 months’ subindex. Westpac said the most likely explanations for the reported deterioration in family finances was some combination of Omicron-related disruption, a rising cost of living (particularly higher petrol prices) and expectations of rising interest rates. On the latter, 66 per cent of respondents now say they expect an increase in mortgage rates over the next 12 months and one in four expects rates to go up by more than a full percentage point.

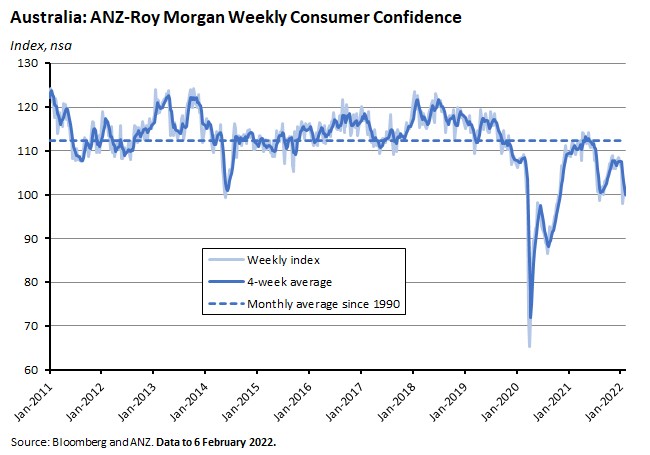

These results were also consistent with those presented in the latest weekly ANZ Roy Morgan Consumer Confidence report, which showed confidence dropping 1.9 per cent last week and reversing the previous week’s gains. The key drivers were a sizable drop in the ‘current financial conditions’ and ‘future financial conditions’ subindices, with both now at their lowest levels since late 2020. Those falls helped take the overall index down to (just) below neutral at 99.9 and well below the series average.

We’re into a new phase of the pandemic

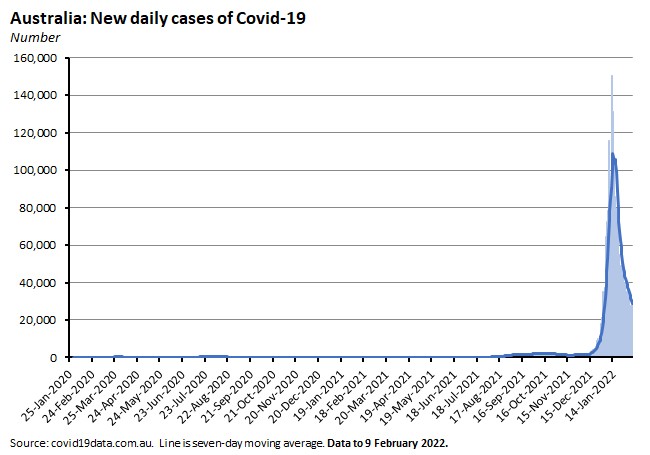

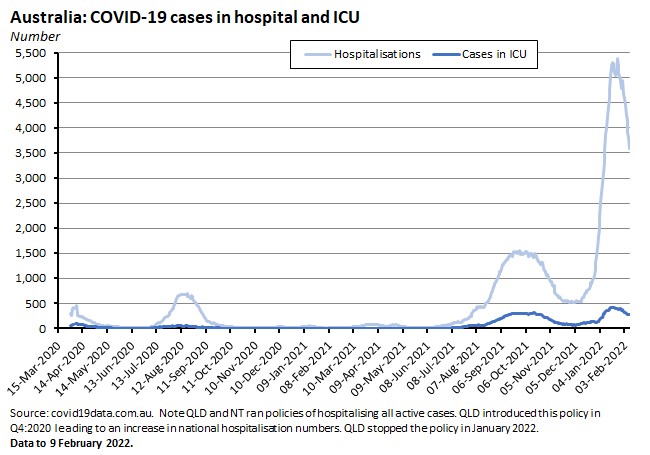

Of course, both business and consumer sentiment have been heavily influenced by COVID-related developments since the turn of the year, as the start of 2022 saw the Australian economy enter a new phase of the pandemic marked by the Omicron variant’s higher transmissibility but lower virulence. Although case numbers jumped dramatically, hospitalisation rates and ICU admissions did not rise in lockstep but instead declined markedly as a share of reported cases. Moreover, all three indicators are now trending down.

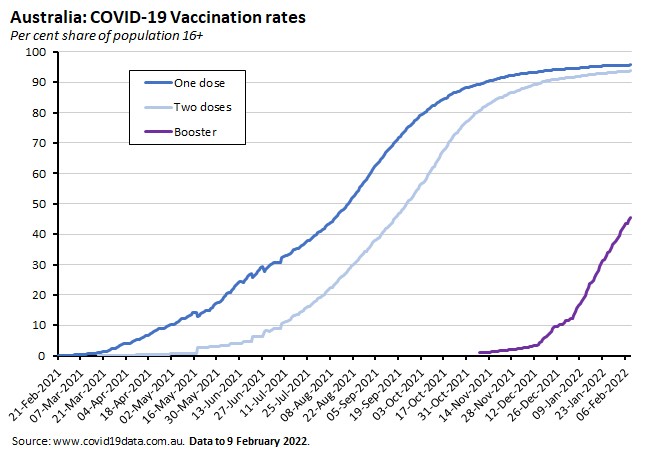

One important factor here has been Australia’s relatively high rate of vaccination coverage, which has contributed to the lower severity of the Omicron variant, although current vaccination rates show that there is still more distance to be travelled with the third (or booster) shot. High vaccine rates and lower severity have then in turn allowed for a change in public health policy and relatively less reliance on direct restrictions on public movement.

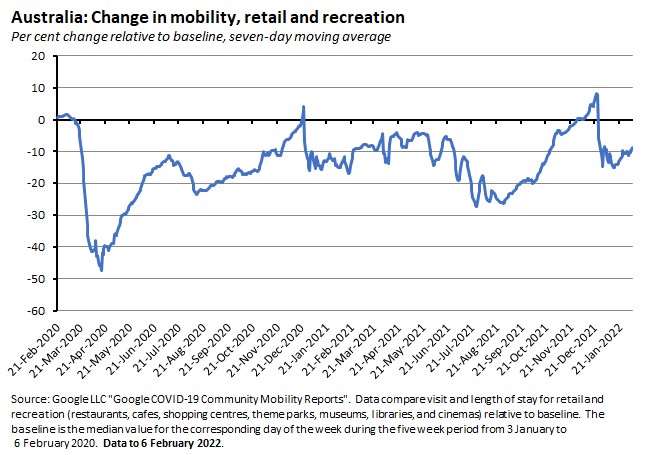

As a result, although the various measures of mobility we track did decline over January this year as COVID case numbers surged, that decline in mobility was quite modest relative to the rise in cases. And again, mobility has since started to recover as case numbers have fallen.

We also know that – as we’ve become more adept at ‘living with COVID’ – the decline in economic activity associated with any given fall in mobility has shrunk. So, while the onset of Omicron does appear to have led to lower consumer spending, and has clearly impacted business and consumer conditions and confidence over the start of this year, the economic hit suffered to date looks to be considerably more modest than the disruptions experienced during previous waves of the pandemic. That in turn leaves the economy well-placed to snap back again, as it has done following previous episodes.

The national and global economies will remain vulnerable to new COVID variants, and it would clearly be premature to declare that we are emerging from the COVID woods. Still, it’s a sign of the changing times that the current economic debate seems to be shifting away from the economic headwinds brought by (imposed) lockdowns and (voluntary) shutdowns and towards concerns around inflation and the future of the cash rate.

What else happened on the Australian data front this week?

Inflation expectations

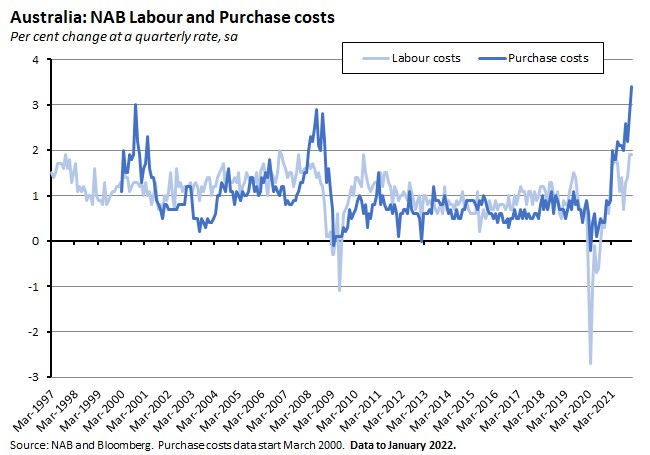

With inflation moving to the centre of the Australian economic debate, gauges of changing inflation expectations will be useful, and this week’s surveys also offered some insights here. NAB’s monthly business survey reported that inflationary pressures remain significant as experienced by Australian businesses, for example, with growth in purchase costs rising to a record high rate of 3.4 per cent in January. The rate of labour cost growth was unchanged last month although it remained at a relatively strong 1.9 per cent.

The ANZ-Roy Morgan report said that ‘weekly inflation expectations’ rose 0.1 percentage point last week to 4.8 per cent, leaving the four-week moving average unchanged.

And the February 2022 Melbourne Institute survey of Consumer Inflation expectations (pdf) noted that consumers now expect the trimmed mean measure of inflation will rise 4.6 per cent over the next 12 months. That’s up on the 4.4 per cent rate reported in January this year but still below December’s 4.8 per cent reading.

ANZ Australian Job Ads

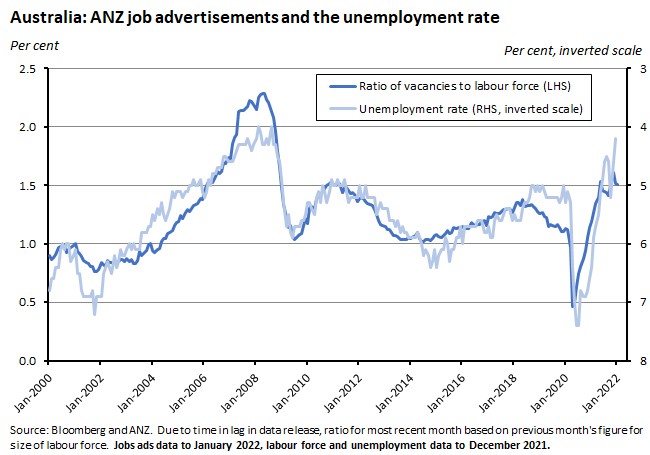

ANZ Job Ads fell 0.3 per cent in January this year (seasonally adjusted) following a downwardly revised 5.8 per cent drop in December. Despite two consecutive monthly declines, Job Ads are still 9.6 per cent above the lows seen during the Delta lockdown, suggesting that hiring intentions have proved to be relatively resilient in the face of the Omicron variant. That in turn is consistent with the rise in business confidence reported above.

Retail trade

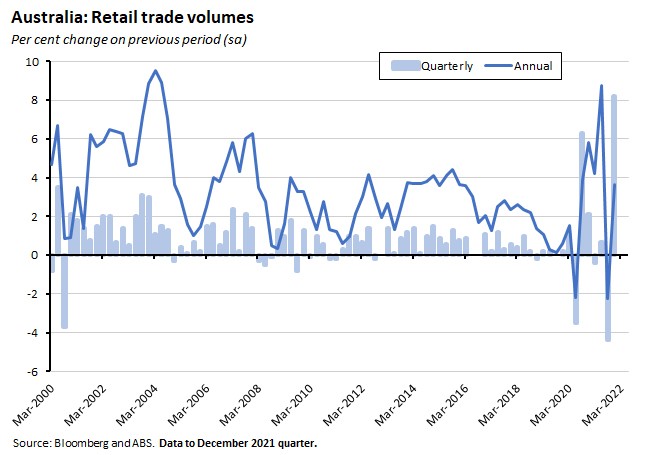

In an update to last week’s release, the ABS said that the volume of retail trade rose 8.2 per cent over the quarter (seasonally adjusted) in Q4:2021 to be up 3.6 per cent over the year. That’s a record quarterly rise (the previous record was set in the September quarter of 2020) and quarterly sales volumes are now at their highest level in the history of the series. The December quarter bounce reflects consumers returning to spending following the end lockdowns related to the Delta variant in October. In the September quarter of last year, retail volumes had fallen 4.4 per cent.

Other things to note . . .

- Returning to inflation, an updated version of our inflation chart pack is now available. This includes a roundup of the December quarter CPI results and also incorporates the updated RBA inflation and labour market forecasts from last Friday’s February 2022 Statement on Monetary Policy (which came out a day too late for the previous issue of the Weekly), along with measures of inflation expectations and charts looking at the global inflation picture.

- The AFR’s Government Editor outlines eight lessons that Australia should learn from our experience with Omicron.

- With a federal election looming, Grattan reminds us that we really should know more about who donates what to our political parties.

- Cameron Murray proposes a Singapore-style solution to Australia’s home ownership challenge.

- The latest Deloitte Access Economics Investment Monitor says that investment will grow in 2022 and then accelerate through 2023 and 2024, adding almost two percentage points to Australian GDP over this period. This year, it estimates that the value of publicly funded infrastructure projects under construction will exceed $300 billion, marking a 50 per cent increase.

- An FT Big Read on the search for a universal coronavirus vaccine. And another one on how to deal with nuclear waste.

- From Nature, Five reasons why COVID herd immunity is probably impossible.

- A useful Economist briefing on the global savings glut and the implications for long-term interest rates that looks beyond the current, short-term focus on the policy response to pandemic-fuelled inflationary pressures.

- Related: one consequence of the pandemic and the government policy response has been a substantial jump in public debt. This VoxEU column on Debt: the eye of the storm provides a brief introduction to the 24th Geneva Report on the World Economy with the same title. The thesis here is that, although the debt levels of households, companies and sovereigns are now at historical highs relative to output, this huge debt boom can also be seen as the flip side of soaring gross savings and financial wealth. In which case, provided that credit supply remains plentiful relative to debt issues and that interest rates remain low, higher debt levels will be sustainable.

- This piece in the American Prospect argues that ‘rampant outsourcing, financialization, monopolization, deregulation and just-in-time logistics’ broke US supply chains in a way that means US capitalism is now facing its equivalent of the Soviet-era communist bread queue.

- Related, Bloomberg Businessweek on how the Biden administration has been trying to rebrand Build Back Better as a new kind of (modern) Supply Side Economics.

- Tyler Cowen argues that the central question of our time may be: how do we stop our new technologies from being weaponised against us? I started reading Nicole Perlroth’s alarming This is How They Tell Me the World Ends at the end of my summer break, and so far that book is doing a great job of reinforcing Cowen’s point.

- A WSJ piece on the booming US labour market.

- The OECD presents a synthesis report on first lessons from government evaluations of COVID-19 responses. Pandemic preparedness was generally lacking, especially relative to the significant human and financial costs incurred. Another key assessment is that building public trust requires transparency, where the latter involves not only frequent and targeted crisis communication but also engaging stakeholders and the public in risk-related decision making.

- The Econtalk podcast chats with John Taylor on inflation, the Fed and the eponymous Taylor rule.

Latest news

Already a member?

Login to view this content