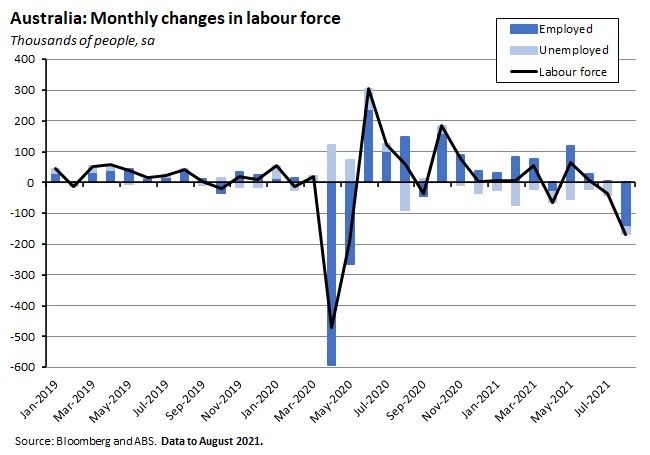

This week’s big data release was the August labour force report, where lockdowns continued to distort some of the headline data. This produced the disconcerting combination of another fall in the unemployment rate – this time to 4.5 per cent, its lowest rate since late 2008 – alongside a drop in employment of more than 146,000 people and a 3.7 per cent slump in hours worked. The explanation for this peculiar blend of outcomes was another big decline in the participation rate as the size of the Australian labour force shrank for a second consecutive month.

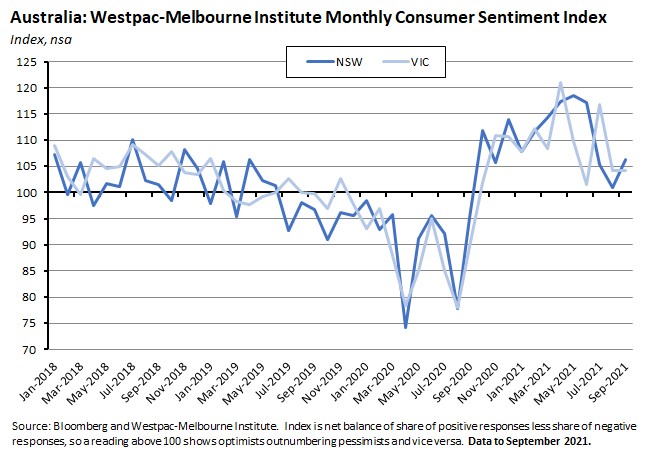

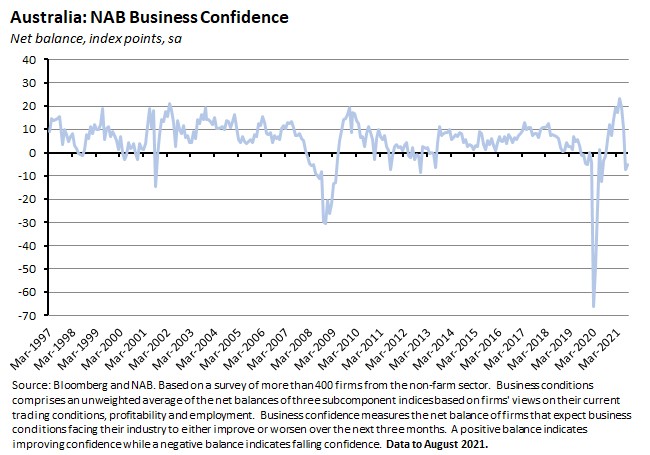

On a more positive note, modest increases in monthly consumer sentiment (for September), and for business conditions and business confidence (for August) both suggest a degree of resilience on the part of households and firms in the face of the Delta variant. While current conditions are taking a toll on the economy, it does appear that the ongoing vaccine rollout means that there is much less uncertainty now than was the case during last year’s restrictions. This week also saw the OECD deliver its latest list of recommended policies designed to boost Australia’s economic performance in the post-COVID era. There weren’t too many surprises here but as usual, the main questions relate not so much to the policy proposals themselves but rather to their political viability/attractiveness.

Note that for those who would like a deeper dive into Australia’s labour market performance, we’ve included a link to another new chart pack this week. This collection looks not just at this month’s labour force numbers but also pulls together recent releases on the industrial structure of employment, vacancies, job ads and wage developments.

This week’s readings and podcast roundup includes the RBA Governor on why markets are getting their forecasts of the cash rate wrong; the ABS presenting new data on Australia’s near-zero rate of population growth; the Productivity Commission explaining why governments should treat the WFH revolution as a potential gain to society; the ‘housing theory of everything’ and a survey of the economic literature on what drives house prices; some reflections on a decade of QE; Sandel and Wooldridge debating the merits of meritocracy; and Tyler Cowen on the End of the Great Stagnation.

Finally, stay up to date on the economic front with our AICD Dismal Science podcast . Listen and subscribe: Apple Podcasts | Google Podcasts | Spotify

What I’ve been following in Australia . . .

What happened:

The ABS said employment in Australia fell by 146,300 people (down 1.1 per cent) in the month to August 2021. Full-time employment dropped by 68,000 people while part-time employment declined by 78,200 people. Total employment now stands at 13,022,600 people, or just 0.2 per cent higher than in March 2020.

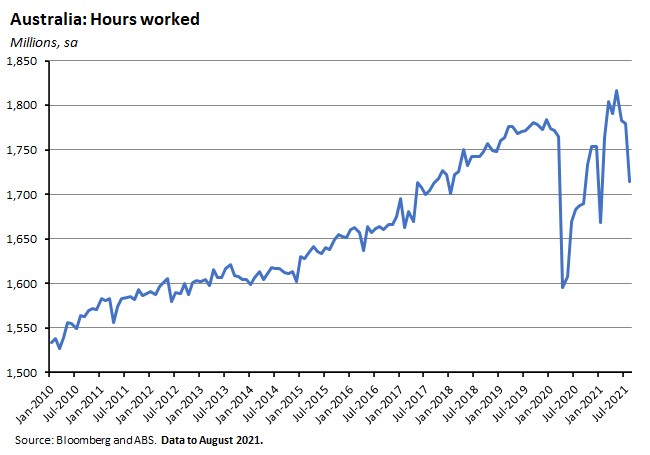

Monthly hours worked in all jobs slumped by 3.7 per cent in August.

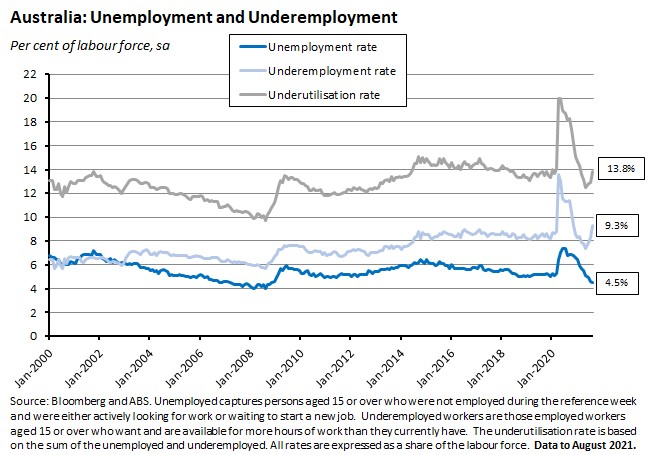

The number of unemployed people fell by 21,900 and the unemployment rate dropped from 4.6 per cent in July to 4.5 per cent in August. The underemployment rate moved in the opposite direction, increasing from 8.3 per cent to 9.3 per cent over the same period. As a result, the overall underutilisation rate increased by 0.9 percentage points in August, climbing to 13.8 per cent.

The participation rate fell by 0.8 percentage points over the month to 65.2 per cent while the employment to population ratio dropped by 0.7 percentage points to 62.2 per cent.

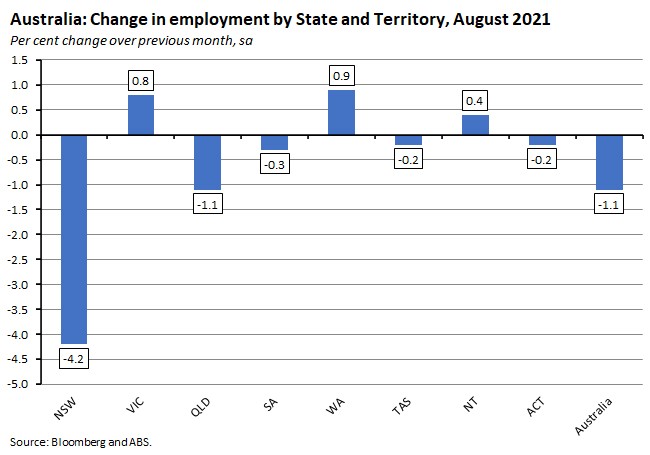

By state and territory, employment slumped by more than four per cent in New South Wales and was down by more than one per cent in Queensland. Hours worked fell by more than six per cent in New South Wales, 5.3 per cent in Queensland and 3.4 per cent in Victoria.

Since the start of the state lockdown in late June this year, employment in New South Wales has now declined by 210,000 people and hours worked have dropped by 13 per cent.

The unemployment rate rose by 0.4 percentage points in New South Wales, increasing to 4.9 per cent, and also jumped by 0.9 percentage points in Tasmania (to 5.5 per cent, the highest rate across all geographies).

Why it matters:

Like its predecessor in July, August’s labour force survey was heavily influenced by the impact of public health restrictions, with the survey data covering the first two weeks of last month and therefore including the continued lockdown in New South Wales as well as new lockdowns in Victoria, Queensland and the ACT. And also like its predecessor, the August report looked quite different to consensus expectations. The median forecast had been for a drop in employment of 80,000, a fall in the participation rate to 65.7 per cent and a rise in the unemployment rate to five per cent. In the event, the fall in employment was much larger than expected but this was offset by a drop in the participation rate that also significantly exceeded expectations. As a result, the unemployment rate fell again last month, dropping to 4.5 per cent. The last time it was that low was back in late 2008.

We noted in our review of that July result that the information content of the unemployment rate changes – actually, deteriorates – under lockdown conditions. In normal times, a fall in the unemployment rate would typically be a strong indicator of a tightening labour market. During lockdowns, however, it can turn into an indicator of the difficulty of being able to actively look for work / be available for work while public health restrictions are in place. As a result, the reported number of unemployed people can drop not because they are finding jobs, but because they are giving up looking for work and exiting the labour force altogether. That effect shows up in a drop in the participation rate and a decline in the size of the labour force, and as noted above, August saw a large 0.8 percentage point drop in the former (taking the rate down to its lowest since last September) and a fall of more than 168,000 in the latter. In the case of New South Wales, where the unemployment rate did increase by 0.4 percentage points over the month, the participation rate also plummeted by 2.5 percentage points.

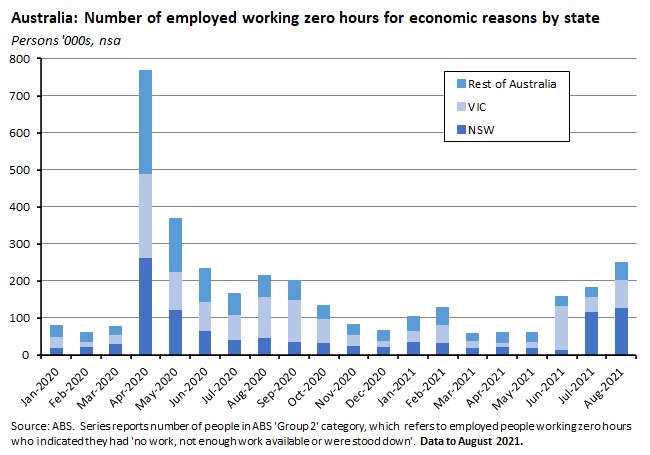

The impact of lockdowns is also very apparent in hours worked which fell 3.7 per cent nationally and by 6.7 per cent in New South Wales. Those declines are much larger than the corresponding falls in employment, indicating that many people in lockdowns had fewer or even no hours of work but still maintained their jobs. That effect showed up in another monthly rise in the underemployment rate, which at 9.3 per cent is back to its November 2020 level, and which has now risen for three consecutive months. Another version of the same effect is also visible in the number of Australians who worked zero hours for economic reasons in August, which rose to almost 249,000. That was an increase of more than 68,000 from the July result and the highest level since May 2020.

In New South Wales the number of people working zero hours for economic reasons rose by 11,400 to 127,400 while in Victoria the number increased by 34,000 to 75,300.

Finally, a reminder that our new Labour Market Chart Pack offers a deeper dive into the data.

What happened:

The Westpac-Melbourne Institute Index of Consumer Sentiment (pdf) rose two per cent to an index reading of 106.2 in September.

The overall lift in the index was powered by robust gains in the ‘economic conditions next 12 months’ subindex (up 4.6 per cent) and the ‘economic conditions next five years’ subindex (up 4.8 per cent) along with smaller gains for ‘family finances vs a year ago’ (up 1.7 per cent) and ‘family finances next 12 months’ (up 2.1 per cent). The only subindex to register a fall in September was ‘time to buy a major household item’ (down 2.7 per cent).

Sentiment in New South Wales rose 5.3 per cent over the month while sentiment in Victoria was unchanged and sentiment in Queensland rose by a strong 8.4 per cent.

Separately, the Unemployment Expectations Index fell 3.3 per cent over the month, indicating that more respondents now expect unemployment to fall over the year ahead.

Finally, September also brought a rebound in sentiment towards the housing market: the ‘time to buy a dwelling index’ rose 8.8 per cent while the Index of House Price Expectations rose 1.4 per cent where it remains close to an eight-year high.

Why it matters:

September’s sentiment reading – with the index rising further above the survey average – suggests that Australian consumer confidence has remained surprisingly resilient in the face of lockdowns in New South Wales and Victoria, the fall in employment and hours worked reported above, and the continued broader disruption generated by the Delta variant.

Westpac points to the vaccine rollout as a key factor behind that resilience, noting that confidence amongst the 57 per cent of survey respondents that have had at least one vaccine dose was running at 103.7 and confidence among the 27 per cent that are unvaccinated for now but willing to be inoculated was even higher at 121.6. In contrast, sentiment in the remaining 16 per cent of respondents who are either unwilling to be vaccinated or undecided is much lower: at a level of around 90, this is the only group for which pessimists outnumber optimists.

What happened:

According to the NAB monthly Business Survey, the business conditions index rose by four points to a reading of +14 index points in August this year.

The rise in business conditions reflected increases in two out of three subindices, with the trading subindex up seven points and the profitability subindex up 10 points. The employment index fell by two points over the month, however.

At the same time, the NAB business confidence index edged up by two points over the month, although the index remained in negative territory at -5 index points.

Forward orders rose 11 points in August, taking the reading back into positive territory after July’s slump to a negative result for the first time in eight months.

Rates of capacity utilisation eased from 81 per cent in July to 80 per cent in August and are now below the series average.

Finally, after having slipped back a little in July, price indicators edged slightly higher again in August and remain at relatively elevated levels: the rate of growth in labour costs rose from 0.9 per to one per cent and the rate of increase in final product prices rose from 1.1 per cent to 1.2 per cent, although the rate of increase of purchase costs was unchanged at 1.9 per cent.

Why it matters:

While lockdowns and fears over the impact of the Delta variant had triggered sharp falls in both business conditions and business confidence in July, August saw both indicators stage modest recoveries. The increase in business conditions keeps that index firmly in positive territory and comfortably above its long-run and pre-COVID levels. Business conditions rebounded in New South Wales and South Australia last month and remain above average in all states, with NAB suggesting that the relative resilience shown by this survey component reflects the economy’s momentum pre-Delta. The strong reading on Forward Orders is also a positive sign in terms of future resilience.

In contrast, business confidence remains depressed, reflecting ongoing uncertainty over the likely duration and extent of lockdowns. Confidence readings are currently deep in negative territory in both New South Wales and Victoria, although the former did see a modest improvement over the month while the latter suffered a sharp decline. Confidence is also low or negative across most industries, with even the hitherto robust construction and mining industries reporting declines.

Finally, it’s worth noting that all of the NAB survey headline indexes and their subcomponents are currently significantly above the lows they fell to in March / April / May of last year, suggesting that – even in the face of Delta – Australian businesses are relatively much more confident regarding both current conditions and the outlook than they were during the early stages of the pandemic when the level of uncertainty was considerably higher and an exit strategy far less visible.

What happened:

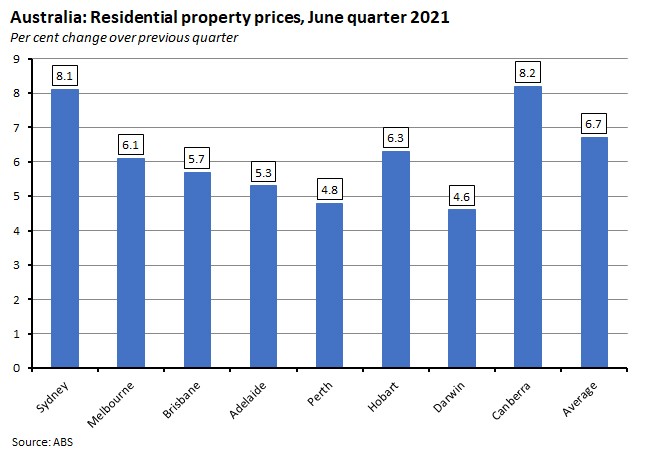

The ABS said the weighted index of the eight capital cities Residential Property Price Index rose 6.7 per cent over the June quarter to be up 16.8 per cent over the year.

All of Australia’s capital cities recorded a rise in prices over the quarter, with the scale of quarterly gains ranging from 4.6 per cent in Darwin to 8.2 per cent in Canberra.

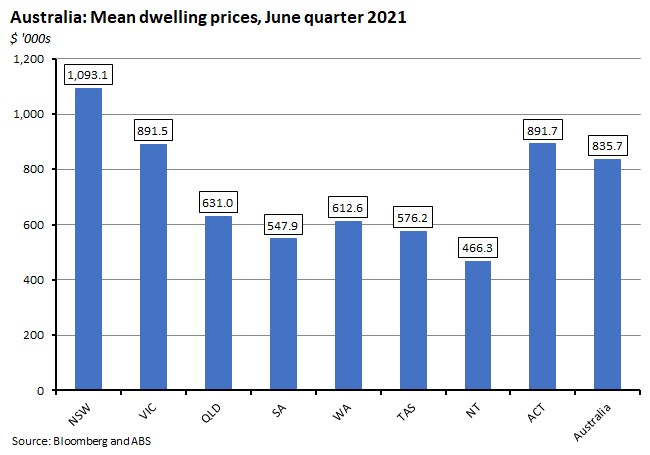

The total value of residential dwellings in Australia rose $596.4 billion to $8,924.6 billion in the June quarter while the mean price of residential dwellings rose $52,600 to $835,700. Mean dwelling prices range from a low of $466,300 in the Northern Territory to a high of $1,093,100 in New South Wales.

Why it matters:

The ABS quarterly data are more of a lagging indicator than the monthly CoreLogic price series that we also track, but the Q2:2021 numbers provide additional evidence of the strength of the Australian housing market pre-Delta, with the June quarterly increase marking the strongest growth in the history of the Residential Property Price series (going back to Q3:2003). Individual capital cities also reported historically high rates of growth: in Canberra the increase was again the strongest on record; Sydney saw its second largest rise on record and largest since Q2:2015; Melbourne its largest increase since 2009; Brisbane and Adelaide their largest rises since 2007; and Hobart its largest gain since 2003. Likewise, the increase in the total value of residential dwellings was also the largest quarterly rise in the history of that series.

The record quarterly rise in prices will also add more momentum to the debate around housing affordability and to questions around the role of monetary policy. With regard to the latter, RBA Governor Lowe addressed the issue in a speech this week (see this week’s readings, below) in which he argued that higher interest rates were not the appropriate policy response to the housing market, making the case instead for a greater focus on structural factors including the tax system and planning and zoning restrictions.

What happened:

The OECD published its latest Economic Survey of Australia. The Survey includes a review of Australia’s current economic circumstances and a set of economic forecasts, although the main interest lies in the OECD’s policy recommendations.

On economic performance and outlook, the OECD notes the change in Australia’s approach to the pandemic, which it reckons is shifting from a policy of zero-tolerance to one of containment. The Survey reports that real GDP is expected to grow four per cent this year and 3.3 per cent in 2022 (that compares to forecast growth rates of 5.1 per cent and 3.4 per cent in the OECD’s May Economic Outlook, respectively), noting that the economic recovery could be ‘more gradual than in previous episodes given it will occur in an environment of higher community transition of COVID-19.’ The unemployment rate is predicted to fall from 5.4 per cent this year to 4.9 per cent next year while core inflation is expected to ease from 2.2 per cent to 1.7 per cent over the same period. The Survey also cautions that ‘risks and uncertainties remain large.’ On the upside, a substantial quickening in the pace of vaccine rollout could enable an early relaxation of containment measures and there is then the potential for rapid consumption growth given a high stock of excess savings. On the downside, significant new outbreaks in other states could deepen the economic shock, vaccine hesitancy could delay re-opening, and a worsening in relations with China could further weaken trade activity.

In terms of policy recommendations, in the short-term the OECD says the focus should be on ensuring macro settings continue to be responsive to changing conditions. Monetary policy should remain expansionary for now, but the RBA should ‘stand ready to tighten policy if underlying inflation risks sustainably rising above the target or inflation expectations risk becoming de-anchored.’ On fiscal policy, the government should seek to restore fiscal sustainability ‘in a gradual manner’ while still standing ready to adopt a more expansionary fiscal stance if required.

Looking further ahead, the OECD suggests a range of initiatives. A (non-exhaustive) list of the proposals put forward includes the following:

- On monetary policy, the Survey suggests that Australia should follow other OECD countries and conduct ‘a review into the monetary policy framework that is broad in scope, transparent and involves consultation with a wide variety of relevant stakeholders.’

- On fiscal policy, it notes that ‘under current policy settings, aging related costs will cause public debt to rise’ and that in addition ‘further investment in the social safety net is needed’.Against that backdrop, tax reform will be required to ‘provide a more sustainable tax base, enhance economic growth and promote other government priorities’ like improving housing affordability and reversing the trend towards rising inequality. The OECD’s proposed tax reform package would include an increase in the GST rate and/or a broadening of the base, with any regressive effects to be offset by additional personal income taxes skewed towards low and middle-income workers; reducing private pension tax breaks; and reducing the capital gains tax discount.It also says more state governments should replace stamp duty with a land tax.The survey also says that Australia’s fiscal framework should be buttressed, including a suggestion that ‘the government’s fiscal strategy should be regularly evaluated and monitored by an independent fiscal institution’ such as the Parliamentary Budget Office (PBO).

- On supporting an inclusive recovery, the Survey recommends further increasing the generosity of Australia’s unemployment benefit and considering indexing the rate to wage inflation.It notes that Australia’s unemployment benefit replacement rate remains close to the lowest in the OECD and below estimates of the relative poverty line.

- On productivity growth, the Survey judges that Australia’s ‘regulatory procedures are relatively complex and the licensing and permit system is cumbersome compared with other OECD countries.’ As well as urging further progress on reforms to the occupational licensing system (including the ‘broadest possible adoption by the states of automatic mutual recognition of licensing across jurisdictions’) the OECD also presses the case for broadly based reform to land use regulations, including by giving local authorities more fiscal autonomy to encourage them to allow the entry of new businesses or households (noting that under current arrangements there is only limited incentive for local authorities in desirable locations to attract new businesses or expand the supply of housing).

- On the financial sector, the Survey advocates reforms that ‘improve access of small young firms to credit and protect the financially vulnerable,’ including by leveraging the digital revolution in financial services, streamlining the Personal Property Securities Register and reducing compliance costs, and completing the implementation of reforms recommended by the Royal Commission into misconduct in financial services.The Survey also notes that although disclosure of climate-related lists by listed companies and financial institutions has increased, ‘progress is uneven and there are still large data gaps’ and therefore advocates a roadmap for ‘improving the consistency, comparability and quality of reporting of climate-related risks by listed companies and financial institutions.’

- On climate policy, the OECD warns that Australia’s carbon emissions will need to decline at a significantly faster pace than is currently the case if the target of net zero carbon emissions by 2050 is to be met, noting that even though Australia has ‘world class public institutions for supporting renewable energy research and the commercialisation of low emissions projects’, nevertheless ‘there has been a trend decline in environmental innovation over the past decade and stronger incentives for innovation and adoption of new low emission technologies are needed.’After noting that a national carbon price would be the most efficient means of achieving this, the Survey notes that alternatives could including the scaling up of existing instruments such as the Safeguard Mechanism.It also says that Australia should develop a ‘national, integrated long-term emissions reduction strategy that defines clear goals and corresponding policy settings for the path to achieving net zero emissions as soon as possible and preferably by 2050.’

Why it matters:

The OECD’s Survey provides a useful insight into what external observers thinks a sensible set of reform priorities for Australia should look like. In that context, there are few surprises here: the recommendations on tax reform including a rebalancing from income taxes to the GST are mostly long-standing ones, the proposition that a national carbon price would be the most efficient way of driving environmental innovation and the adoption of low-emissions technology is hardly news, and the cases for improving the generosity of Australia’s unemployment benefits and for the reform and streamlining of cumbersome regulatory, licensing and permits systems are arguably also fairly well-established.

The idea for a review into the monetary policy framework would bring Australia into line with a range of OECD economies that have already followed this path, and makes sense given the changed global and national economic circumstances and the RBA’s repeated inability to meet its inflation target. Likewise, given the fact that the COVID crisis has driven an effective revolution in fiscal policy, giving some serious consideration into strengthening and updating fiscal frameworks is a logical response, albeit one that politicians are likely to be reluctant to embrace given the potential electoral potency of fiscal levers.

From a strictly economic point of view, then, most of the OECD’s recommendations should not be particularly controversial. When it comes to the political economy of several of these recommendations, however, the picture looks rather different.

What I’ve been reading . . .

RBA Governor Philip Lowe gave an address to the Anika Foundation on Delta, the Economy and Monetary Policy. In his speech, Governor Lowe covered the RBA’s views on the recovery, the recent move to taper-but-extend asset price purchases, the future of the cash rate, and housing prices:

- He noted that the RBA thinks the Australian economy will ‘contract significantly’ in the September quarter – by at least two per cent and possibly by ‘significantly larger than this’ – but that while this will be ‘a major setback’ it is also ‘likely to be only temporary’ with growth resuming in the December quarter.Underpinning that optimism are the increasing rate of vaccination and the consequent scope for the easing of restrictions on economic activity, which under the RBA’s central scenario would see economic activity ‘back on its pre-Delta track by the second half of next year.’

- Further optimism about Australia’s outlook comes from the view that international experience ‘suggests that having COVID-19 circulating in the community does not prevent a quick bounce back in spending, providing the population is highly vaccinated’ along with the ‘substantial income support…provided by the Australian government,’ and rising household wealth due to higher housing prices.

- On last week’s decision to taper while also extending the life of the RBA’s asset purchase program, this was explained in terms of an expected delayed but not derailed economic recovery along with the judgment that fiscal policy rather than monetary policy is ‘the more effective policy instrument’ for dealing with Delta, because the public sector balance sheet can offset the hit to private incomes during lockdowns in a more effective manner than monetary easing.

- In the case of the cash rate, Lowe’s speech highlighted the apparent disconnect between the RBA’s messaging (no increase likely before 2024) and market pricing, which implies that cash rate rises will come much sooner.Here the Governor said that these expectations were difficult to reconcile with the RBA’s views on the likely trajectory of wages and prices, and that he found it ‘difficult to understand why rate rises are being priced in next year or early 2023.’

- Finally, Lowe also argued against the case for using higher interest rates to cool the property market, saying that would mean lower housing prices would come at the cost of ‘fewer jobs and lower wages growth’ and that this would be ‘a poor trade-off in the current circumstances.’Better, he suggested, to look to ‘the structural factors that influence the value of the land upon which our dwellings are built…the design of our taxation and social security systems; planning and zoning restrictions; the type of dwellings that are built; and the nature of our transportation networks.’

- The contents of the latest RBA Bulletin are now online. Topics covered in this issue include small business finance and COVID-19 outbreaks, climate change risks to Australian banks, implications for Australia of net-zero emissions targets in China, Japan and South Korea, the financial cost of job loss, and pieces on China’s labour market and China’s evolving financial system.

- The ABS published data on Australia’s national, state and territory population as of the March quarter of this year. Australia’s population was 25.7 million people on 31 March 2021. Over the year to March, population increased by 35,700 people, or just 0.1 per cent. That comprised a 131,000 gain through natural increase that was largely offset by negative net overseas migration of 95,300. Most states and territories saw positive population growth over the year to March, with the exception of Victoria where population shrank by 0.6 per cent reflecting the impact of net overseas migration. Growth was fastest in Queensland, at 0.9 per cent, powered by net interstate migration.

- The ABS also released data on overseas arrivals and departures for July 2021. The numbers show total arrivals dropping 27,620 over the month to 74,860 and total departures falling by 11,320 to 87,020 trips. Both numbers remain a fraction of their pre-COVID levels. International student arrivals in July were just 510, down 99.6 per cent compared to pre-COVID levels in July 2019. The ABS also published data for 2020-21 which showed that there were 150,880 visitor arrivals in the year, down 97.8 per cent on 2019-20.

- Adam Triggs reckons that a (shorter and smaller) post-Delta economic boom might be the last chance to deliver reform during good times.

- Why hasn’t Australia developed its own mRNA vaccines?

- The Productivity Commission (PC) has released a new research paper on working from home. The headline judgment is that ‘on balance working from home can unlock significant gains in terms of flexibility and time for employees and could even increase the nation’s productivity.’ The paper argues that while it’s appropriate for governments to monitor labour market and regulatory settings, there ‘is a strong case to allow workers and firms to negotiate mutually beneficial outcomes.’ There will be consequences for CBDs, with some activity likely to shift to the suburbs, and some decline in the demand for office space but the PC judges that not only will there be offsetting opportunities in the suburbs and regions, but that in practice ‘the death of the CBD has been greatly exaggerated’ as urban areas will continue to be attractive hubs of economic activity. In this context, the role of government ‘overall should aim to smooth, rather than impede, the transition to different models of work.’

- The Lowy Institute on Beyond Fortress Australia including John Edwards on the arithmetic of isolation.

- Two of my former Lowy colleagues offer somewhat different takes on AUKUS and submarines, both in the AFR.

- An essay on the housing theory of everything (via FT Alphaville). Is it possible to blame slow growth, poor health, financial instability, economic inequality and falling fertility on housing shortages?

- This VoXEU column provides a useful survey of lessons from the economic literature on what drives house prices in the form of five major lessons: (1) the efficient market rational expectations paradigm is a poor fit for housing markets, which are rife with heterogeneity, trading and search costs, transaction delays, asymmetric information and credit constraints, all of which contribute to a slow adjustment of prices to changes in fundamentals; (2) simple house price-to-rent arbitrage models (which propose that the value of a home is given by the discounted present value of future rents, and therefore that the price-to-rent ratio will move in line with the (inverse) of the user cost of housing) are inappropriate for a range of reasons including that owner-occupied and rental properties are only imperfect substitutes, the presence of other barriers to arbitrage between renting and buying including large transaction costs and volatile prices, and the existence of significant credit constraints; (3) shifts in credit conditions on the other hand are a key driver of house prices; (4) differences in the response of land supply do a good job in explaining variations in prices, with e.g. house price bubbles across US metros larger and more frequent in more supply-inelastic markets, where supply elasticities are driven by differences in the availability of land; and (5) increased demand for space combined with dramatic policy interventions (conventional and unconventional monetary policy targeted at driving down long-term interest rates, moratoria on foreclosures and repossessions, large transfer payments) help explain why the pandemic crisis saw house prices rise sharply. The column’s bottom line: don’t just focus on real interest rates as the sole driver of house price booms and busts.

- Also from VoxEU, in the context of claims about the ‘twilight of democracy’, Acemoglu et al draw on survey data covering more than 110 countries to provide some empirical support for the proposition that exposure to democracy will generate support for democracy (and therefore be self-sustaining) provided that democracies can successfully deliver on promises of economic growth, peace, political stability, and the provision of essential public goods.

- An FT Big Read on the battle to control football: FIFA (national teams) vs UEFA (big clubs).

- A Nature feature sets out the history of mRNA vaccines.

- The Brookings Papers on Economic Activity Fall 2021 Conference has a selection of session materials online including draft papers, slides and video.

- Manufacturers vs retailers in the race to hire US workers. Retail (at least in the form of Amazon and WalMart) looks to be winning, in what could turn out to be a new source of deindustrialisation.

- Greg Ip on the world’s shifting preference from military to economic warfare. More sanctions are becoming the tool of choice for the United States, but also for China, Russia and others.

- Robert Skidelsky reviews a decade of QE. Why have billions of dollars of central bank bond purchases had such a minor effect on the general price level?

- A couple of podcasts to finish: Intelligence Squared hosted a debate between Michael Sandel and Adrian Wooldridge on Meritocracy (I’ve linked to them both individually in the past on this topic, so it was interesting to listen to them square off); and Ezra Klein quizzes Tyler Cowen on the End of the Great Stagnation.

Latest news

Already a member?

Login to view this content