The key data release this week was the January 2022 labour force report which set out the impact of the Omicron variant on the job market. The main message here was one of relative resilience: despite a sharp fall of almost nine per cent in hours worked and a small rise in the total number of unemployed, the unemployment rate was unchanged at 4.2 per cent, the participation rate rose and total employment edged higher thanks to a rise in part-time jobs. A sub-four per cent unemployment rate now beckons.

The rest of this week’s note includes the usual roundup of other Australian data releases including the minutes from February’s RBA board meeting, weekly consumer confidence numbers and ABS survey data on labour market and supply chain disruptions. This week’s selection of links includes our latest labour market chart pack (which provides more detail on the labour force survey including state-level numbers), economic testimony from the RBA and Treasury including the latter’s goldilocks scenario for the Australian economy, some thoughts from the ECB on bottlenecks and monetary policy, a review of the evolution of global poverty, a look at what the changing price of the humble nail can tell us about economic development, and Michael Lewis on how Wall Street has changed since his 1989 book, Liar’s Poker.

Listen and subscribe to our podcast: Apple Podcasts | Google Podcasts | Spotify

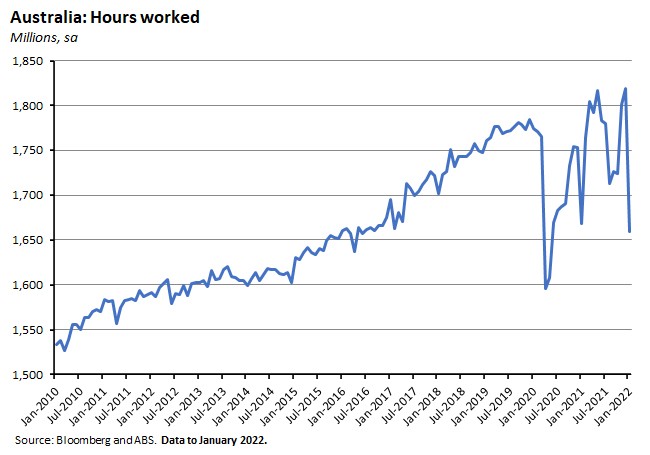

Hours worked slumped in January

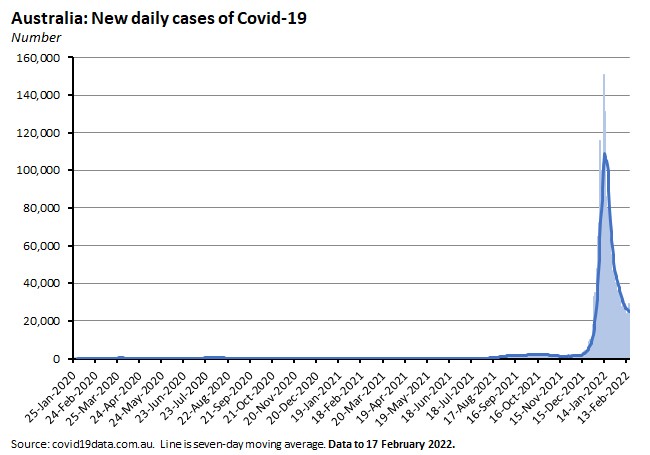

This week’s key data download offered some important insight into how the Australian labour market coped with the huge surge in COVID case through January 2022.

The headline result was that the impact of the Omicron variant manifested in a dramatic 159.4 million hours’ (8.8 per cent) slump in hours worked. That was a large enough hit to take the total number of hours worked in the Australian economy down to six per cent below the level of hours worked pre-pandemic in March 2020.

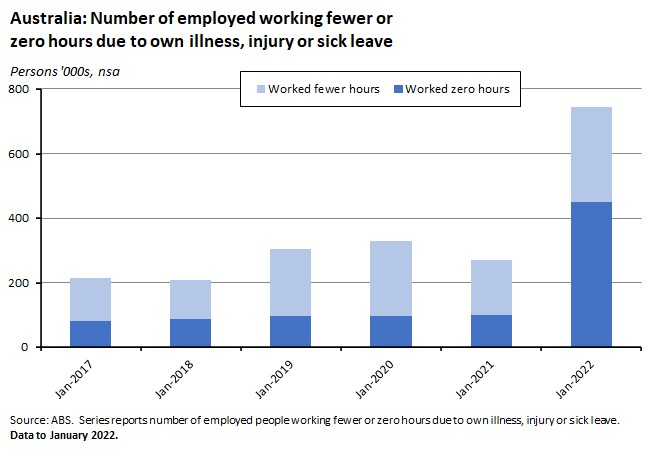

The collapse in hours worked was the result of more people than usual taking annual leave and sick leave in the first two weeks of January. To some extent, January last year had seen a similar pattern, with hours worked falling 4.9 per cent as more people than usual took annual leave. And that pattern was repeated last month, albeit with even more people taking a holiday. A key difference this January, however, was that last month’s results were also heavily impacted by a substantial increase in the number of people taking sick leave: the number of people working reduced hours due to sickness was about three times more than the pre-pandemic average for the month of January while the number of people working no hours at all due to sickness was more than four times the pre-pandemic average. This, then, was the Omicron effect as measure by labour market data.

But the labour market overall remained resilient

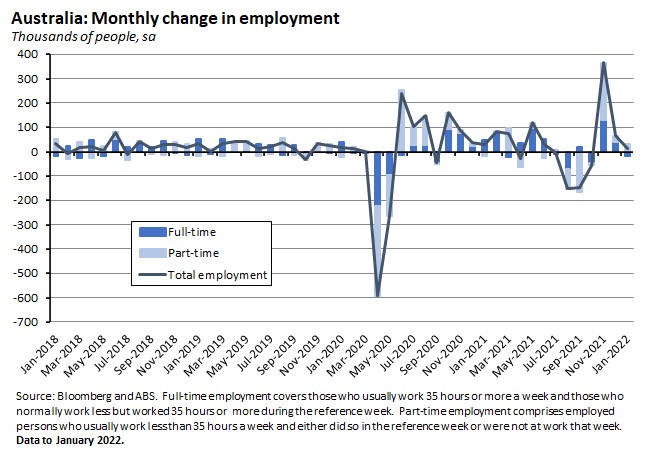

Despite this serious shock to working hours, however, the other labour market indicators for the month suggested a significant degree of resilience. For example, while the market consensus had expected total employment to be unchanged relative to December, the economy was actually able to add more than 12,900 jobs as an increase in part-time employment more than offset a smaller fall in full-time jobs.

At the same time, the participation rate rose to 66.2 per cent (just below its record high of 66.3 per cent) and the employment to population ratio climbed to 63.4 per cent. The latter is a new record and is a full percentage point higher than the pre-pandemic ratio.

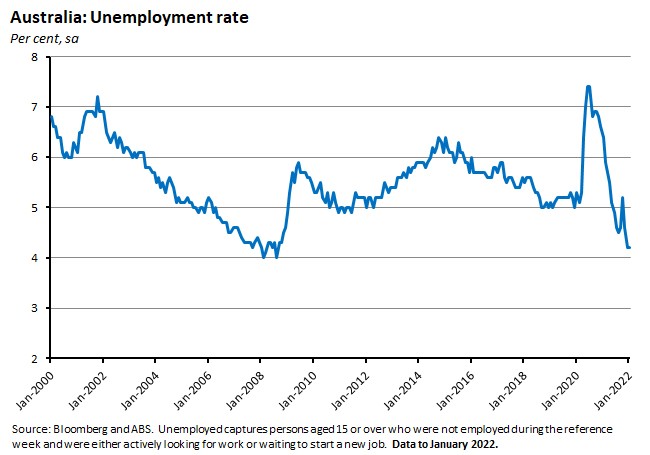

The unemployment rate was unchanged at 4.2 per cent last month – it’s lowest rate since August 2008 – and although the underemployment rate did increase, it only rose by 0.1 percentage points to 6.7 per cent. At that rate, it remains more than two percentage points lower than the March 2020 level.

A sub-four per cent unemployment rate is now in reach

The marked divergence between the sizable fall in hours worked and the modest rise in employment in the January numbers suggests that employers have mostly decided to look through the near-term business disruption created by Omicron. That in turn augurs well for the ambition of policymakers at the RBA and Treasury to drive the unemployment rate down to below four per cent for the first time since the 1970s. Not only has the labour market proved able to navigate Omicron relatively successfully, but it has also been capable of absorbing a participation rate that is close to its record high.

Further adding to this sense of optimism, the ABS also reported this week that the number of people unemployed but with a job attachment rose to 0.5 per cent of the working age population in January 2022 (previously, the Bureau has explained that high levels of job attachment were a key factor in the rapid recovery of employment from the Delta variant). It also said that the number of people who were classified as ‘future starters’ (those waiting to commence a new job within four weeks from the end of the labour force survey reference week) was slightly higher than usual last month – a pattern that is typical for the end of lockdown periods and for the start of the year.

All of which suggests that a further fall in the unemployment rate looks likely. Is there anything that could derail that positive outlook? There are a few downside risks worth noting (aside from the arrival of a new COVID variant and other international shocks).

- First, if the participation rate continues to rise, it’s possible that employment creation might fail to keep pace. Still, as already noted, the participation rate is already close to its record level and the labour market has been able to cope.

- Second, changes in labour market conditions could alter the picture. In particular, the move to more open borders could lead to a change in labour demand (via a change in spending patterns and levels) and labour supply dynamics, although both effects could take time to emerge.

- Third, the big gains in employment to date are in large part a product of very stimulative monetary and fiscal policy settings. Any marked tightening of those settings would therefore imply a change in the labour market outlook. With both the RBA and Treasury stressing that they are targeting ‘full employment’ there’s reason to rule out any dramatic shifts in the near-term. See the discussion on the RBA minutes and the comments around recent RBA and Treasury testimony below for more details here. But if a rapidly tightening labour market triggers a sudden surge in wage growth, for example, the central bank in particular will be under pressure to move more decisively on the cash rate.

Finally, and in regard to that last point, keep an eye out for the December quarter Wage Price Index (WPI) reading, due next Wednesday.

What else happened on the Australian data front this week?

RBA minutes for the 1 February 2022 Monetary Policy Board Meeting

This week’s RBA minutes offered more detail on the first monetary policy meeting of the year although they added little to the information already provided by the Governor’s 2 February speech and the February 2022 Statement on Monetary Policy. They set out the RBA’s view that the economy had bounced back strongly in the final quarter of last year and that the Omicron variant was expected to have seen growth slow in the March quarter of this year. At the same time, this COVID-induced slowdown is predicted to have a much smaller impact on economic activity than pervious waves (due to higher vaccination rates and less severe health outcomes leading to a reduced need for lockdowns) and economic growth is expected to strengthen through the middle of this year.

February’s meeting saw the RBA exit from its QE program and the minutes noted that the better-than-expected progress on the RBA’s inflation and employment goals (‘the achievement of the goals was within sight for the first time in several years. The unemployment rate was at its lowest level since 2008 and underlying inflation was in the middle of the target range for the first time since 2014’) helped the Board decide that it was time to end the bond-buying program. The Board did not, however, decide on the reinvestment of the proceeds of maturing bonds held by the RBA. The minutes said that there are large gaps in the maturity profile of government bonds, with the next maturity not until July this year. That gives the RBA time to decide on reinvestment, which the minutes said it will now do in May this year.

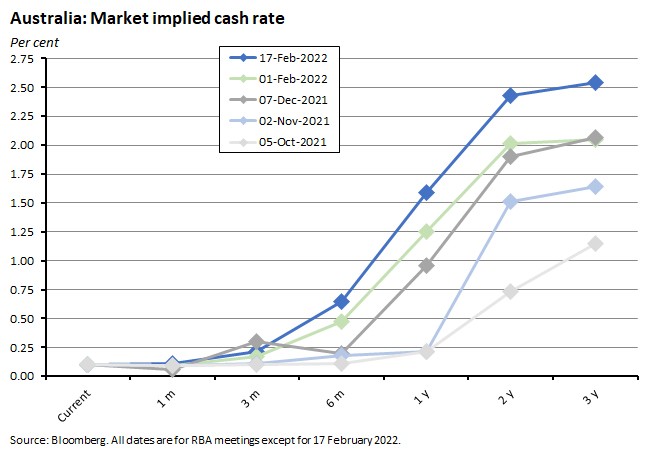

On the cash rate, the minutes reiterated the position that the Board ‘will not increase the cash rate until actual inflation is sustainably within the two to three per cent target band’ and that, despite the recent pickup in inflation, ‘members agreed it was too early to conclude that it was sustainably within the target band.’

Financial markets continue to price in a much more aggressive policy normalisation cycle than implied by RBA commentary, however. Indeed, expectations of the degree of policy adjustment have increased further since February’s RBA meeting: At the time of writing, market pricing implied five cash rate hikes by the December 2022 meeting and the cash rate is anticipated to be a little above 2.5 per cent three years from now. Note that the last time it was at that level was between August 2013 and February 2015 (when the RBA announced a 25bp cut that marked the start of a slow slide in the policy rate that continued up to the COVID crisis). Also note that, assuming that the RBA is hitting its inflation target, that only implies a real cash rate of around zero.

ANZ Roy Morgan Consumer Confidence

The weekly ANZ-Roy Morgan Consumer Confidence index rose 3.3 per cent last week, taking the index back above neutral to a level of 103.2. The index is now at its highest level since the first week of January this year although it remains well below the long-run series average of 112.4. The weekly rise in confidence came despite retail petrol prices rising to record highs and likely reflects continued falling Omicron case numbers and lower hospitalisations along with the news of the re-opening of international borders to vaccinated tourists.

Weekly inflation expectations rose 0.2 percentage points to five per cent, although the four-week moving average was unchanged at 4.9 per cent.

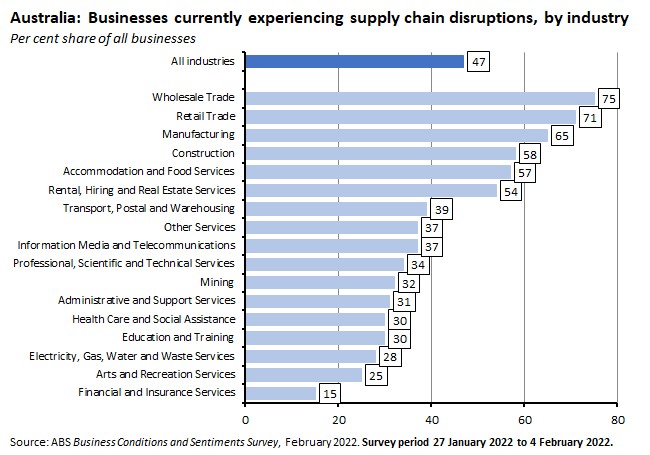

ABS survey data on supply chain disruption and staff shortages

Last Friday, the ABS released the January 2022 Business Conditions and Sentiments survey which provided information on supply chain disruptions and staff shortages. Nearly half (47 per cent) of all respondents said they were currently experiencing supply chain disruptions compared to 30 per cent in April 2021, which was the last time this information was collected. Of those reporting disruptions, 36 per cent said they were affected to a great extent (major delays, unobtainable items, a significant impact on revenue) and 61 per cent to a small extent (some delays but little impact on revenue).

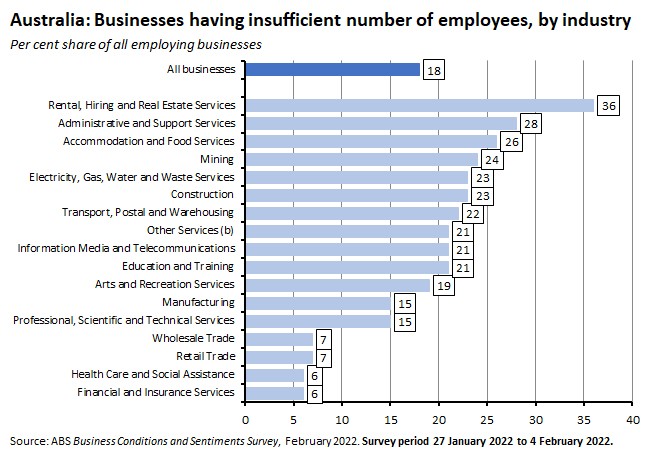

On staff shortages, 18 per cent of employing businesses said they did not have enough employees based on current operations, down from 19 per cent in June 2021 but above the 12 per cent share reported in March 2021. Of those businesses reporting staff shortages, 69 per cent said they were struggling to find suitable staff, 62 per cent were affected by COVID-19, 53 per cent cited availability of existing employees to work, 44 per cent cited the affordability of additional staff, and the same share cited international border closures. Some 33 per cent cited domestic border closures and 30 per cent reported difficulty retaining staff.

Finally, in terms of the impact of COVID-19 on employee availability, 22 per cent of all employing businesses reported that some existing employees were currently unavailable due to COVID-19. For this group, 82 per cent cited self-isolation or quarantine requirements as COVID-related factors affecting employee availability while 73 per cent cited staff with COVID-19 symptoms or illness and 41 per cent cited caring responsibilities. In addition, 33 per cent cited pending COVID-19 test results and 21 per cent concerns about catching COVID-19.

The ABS survey was conducted between 27 January and 4 February this year.

Overseas arrivals and departures

The ABS said that total overseas arrivals in Australia rose to 195,760 trips in December 2021, an increase of 123,520 trips (note that the measure here is the number of international border crossings). Total departures in the same month numbered 227,230 – an increase of 136,130 trips.

Short-term visitor arrivals rose to 73,070 in December, in the strongest monthly result since March 2020. Over 2021 as a whole, there were 245,770 short-term visitor arrivals. That was down 86.6 per cent on 2020 numbers, which at 1.8 million were already well below the more than 9.2 million arrivals recorded in 2019, pre-COVID. New Zealanders accounted for nearly 40 per cent of all short-term visitor arrivals last year, which the Bureau attributes to the impact of the ‘trans-Tasman travel bubble’ that was in place from April to July 2021.

Count of Australian Businesses

According to the ABS, as of 30 June 2021 there were 2,402,254 actively trading businesses in the Australian economy, marking a 3.8 per cent (87,806) increase over the year. The rate of business entry was 15.8 per cent while the exit rate was 12 per cent.

Other things to note . . .

- Our latest labour market chart pack is available.

- The RBA’s opening statement to the House Standing Committee on Economics. Key paragraph: ‘I recognise that there is a risk to waiting but there is also a risk to moving too early…we have the opportunity to secure a lower rate of unemployment than was thought possible just a short while ago. Moving too early could put this at risk. At the same time, we are committed to maintaining low and stable inflation and will do what is necessary to achieve this important goal. The stronger the economy and the more upward pressure on prices and wages, the stronger will be the case for an increase in interest rates.’ And a link to the Hansard Transcript (pdf) where the Governor says ‘..the approach that we're running at the moment—waiting for the evidence—does run the risk that inflation will be above three per cent for a period of time. That risk is acceptable. In fact, I think running that risk is the appropriate thing to do.’

- Treasury Secretary Steven Kennedy’s opening statement to the Economics Legislation Committee. According to Kennedy, despite expecting a significant impact from Omicron on labour supply in January, Treasury’s ‘current assessment is that the negative impact on aggregate spending has been relatively muted’ and it ‘does not expect the Omicron wave to have a large negative impact on employment.’ He also argued that current economic circumstances mean that ‘it is important that the withdrawal of fiscal policy support is tapered’, partly to allow space for a normalisation of monetary policy, but also to seize ‘the opportunity to achieve full employment.’ The statement concludes with the tantalising possibility of a goldilocks scenario for the Australian economy: ‘an unemployment rate with a three in front of it or at the very least settling in the low fours, rising productivity back towards 1.5 per cent per year, inflation settling in the middle of the band and nominal wages growing at four per cent.’

- Richard Holden proposes that small businesses need government support to deal with the ‘shadow lockdown’ triggered by the Omicron outbreak.

- New ABS data on COVID-19 mortality in Australia. The ABS said there were 2,639 death registration where an individual is certified as having died from or with COVID-19 between the start of the pandemic and 31 January 2022. That means that roughly one per cent of the 273,901 death registrations received by the ABS during the pandemic are of people who have died with or from COVID-19.

- A summary of ABS research on land and housing supply indicators. The Bureau is planning to release experimental estimates on counts of number and shares of lot parcels by zoning and size, and numbers of dwellings approved by zone and lot size for major urban areas.

- Grattan attempts to gauge the relative contributions of closed borders and macro stimulus to Australia’s labour market performance.

- In the AFR, Ruchir Sharma reckons that a post-COVID world will be marked by slower growth and faster inflation. The pandemic has triggered ‘a baby bust, a migration bust and a wave of retirement and quitting’ that have added headwinds to productivity growth and that will then compound the growth retarding impact of deglobalisation, demographics and debt. At the same time, he argues, temporary inflation pressures caused by supply chain dislocations and macro stimulus will be sustained by shrinking workforces and rising wage pressures.

- The FT’s Martin Wolf warns of the looming threat of long financial COVID. AFR version.

- The WSJ’s Greg Ip on Russia, Ukraine, (de)globalisation and the consequences of sanctions.

- Yuval Noah Harari on Ukraine and Russia.

- The IMF says that tracking median or trimmed mean measures of US inflation is likely do a better job of tracking price pressures than traditional ‘core’ inflation measures that exclude food and energy. That’s because in recent years the core measure has been almost as volatile as headline inflation as there have been large price changes outside food and energy including airline, hotels, sporting events and financial services. Note that here in Australia, the RBA’s preferred measure of underlying inflation has long been the trimmed mean.

- ECB blog post on bottlenecks and monetary policy.

- A VoxEU column arguing that teleworking (for most workers likely in the form of hybrid work) is here to stay.

- Research from Brookings looking at the evolution of global poverty between 1990 and out to 2030. The past three decades have brought big declines in global poverty, led by (especially) China and India. In December 2020, China announced that it had eliminated extreme poverty and the paper thinks that India will be close to making the same boast by 2030, with the only Asian countries unlikely to have met that goal by then comprising Afghanistan, PNG and North Korea. The authors argue that while poverty in 1990 was concentrated in low-income Asian countries, current and future poverty is largely to be found in Sub-Saharan Africa and fragile and conflict-affected states. Nigeria is now the ‘global face of poverty’ overtaking Indian in 2019 (although COVID-19 has seen India temporarily reclaim this unwanted title). By 2030, the authors suggest that poverty will be associated not just with countries but with specific areas within countries.

- The latest issue of the Journal of Economic Perspectives is now available. As well as a symposium on the economies of Africa and a piece looking at dramatically declining US birth rates since the Great Recession (conclusion: it’s a puzzle, but other than the impact effect of the Recession itself, there are no obvious explanations, although possibilities include changing societal preferences for children, broader career options for women and changes in the nature of parenting), there’s this lovely piece on The Price of Nails since 1695. The price is estimated to have fallen by a factor of about ten, or an average per annum fall of about 1.5 per cent. At the same time, the share of nails in US GDP is estimated to have dropped from 0.4 per cent in 1810, which is comparable to today’s share of household purchases of personal computers, to less than 0.01 per cent by 2017. The idea behind the paper is that these changes over roughly three centuries in the price of a basic manufactured product offer a neat way of thinking about long-run economic and technological change. It turns out that most of the price fall reflects gains in productivity growth with the ‘golden age’ of nail manufacturing running from the late 18th century to the mid-20th century. Since then, the real price of (domestically produced) US nails has risen considerably, in part reflecting higher materials prices. Some of this was offset by the introduction of nail guns in the 1980s, which significantly lowered the ‘all-in’ price of an installed nail.

- A selection of podcasts to finish. First, Tyler Cowen in conversation with Sebastian Mallaby on the venture capital sector. Next, the Odd Lots podcast interviews Michael Lewis on how Wall Street has changed since the 1989 publication of Liar’s Poker. Finally, the Ezra Klein podcast talks to Jason Furman on what is going on with the US economy.

Latest news

Already a member?

Login to view this content